Your Ultimate GST Filing Software

Looking for the best GST software for return filing that simplifies your compliance?

WebLedger provides an exhaustive and simple-to-use GST filing software that is meant to make GST easy for professionals such as CAs, Tax Officers, and Compliance Officers. This module will help keep your clients up to date with all GST rules, allowing you to say goodbye to tiresome filing procedures.

Please enter the OTP below to proceed.

Smarter Solutions for Flawless GSTR Filing

WebLedger’s GST Return Filing Software simplifies compliance with automated modules for GSTR-1, 2A, 2B, 3B, 9, and 9C, along with reconciliation tools like GSTR-1 vs 3B and 2A/2B vs ITC. It streamlines monthly, quarterly, and annual filings, tracks supplier data, and optimises input tax credit accuracy – making GST management efficient, error-free, and audit-ready.

Our GSTR Filing Software makes it easy for you to file your monthly and quarterly GST Return-1 with the GST Government of India Portal. You can report every sale made during the month or quarter, helping your business follow GST rules. This automated system helps to streamline the process. Thus, making it simple to keep accurate records and stay compliant.

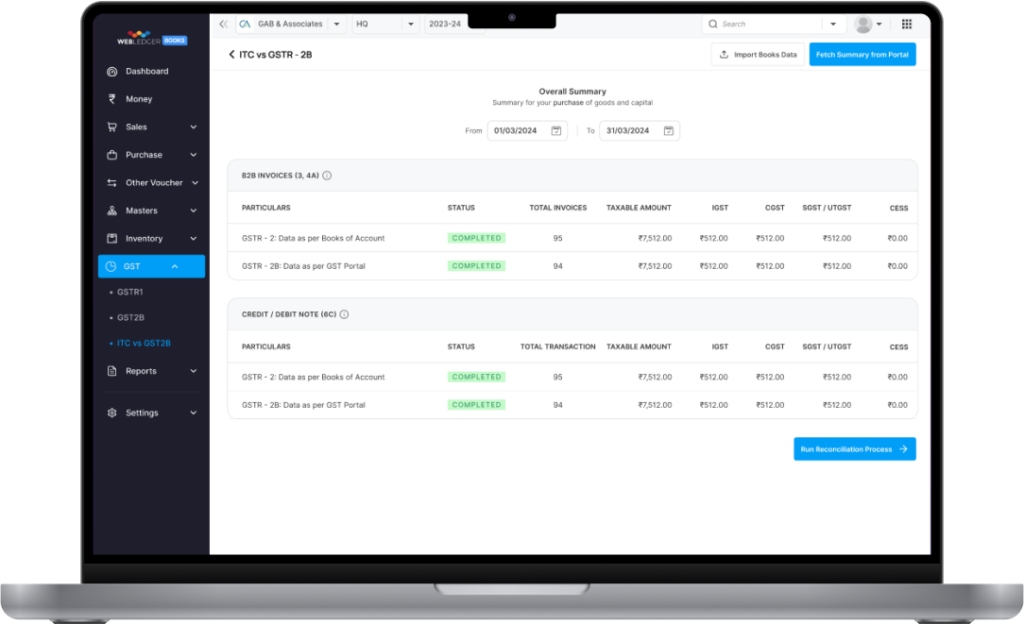

Keep track of your purchase data with our GSTR-2A and 2B tracking feature. These returns help you see the data your suppliers have submitted about your purchases. By filing GSTR-2A and 2B in a proper way, you can ensure accurate records for your input tax credit. Thus, improving your compliance management.

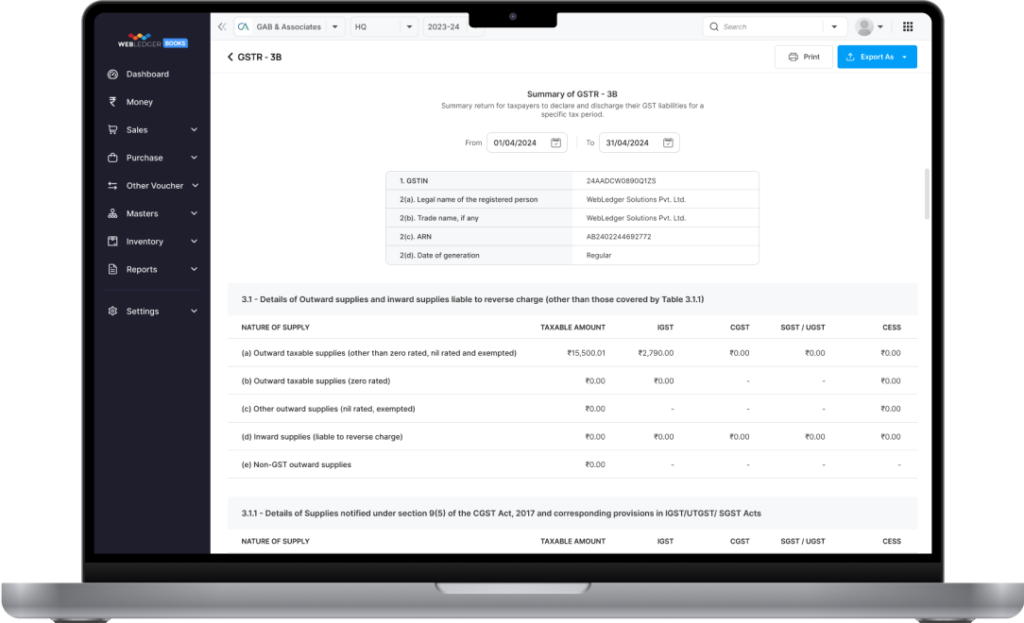

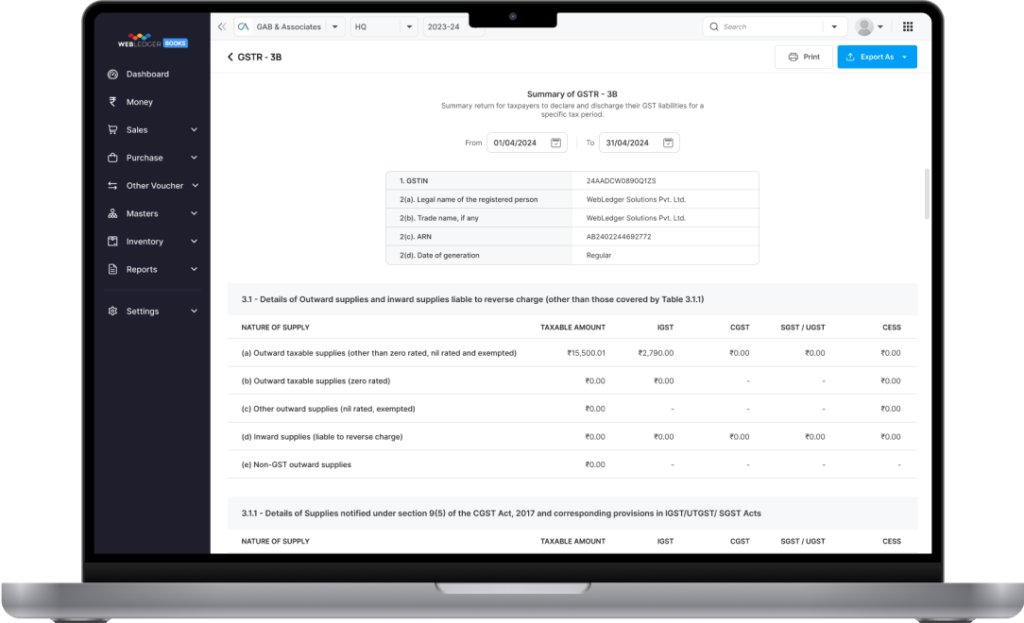

Our software supports filing GST 3B returns monthly or quarterly. This return is important because it lets you report a summary of your purchases and sales, and pay any GST you owe. You can also claim credit for any extra GST you paid on purchases, helping you maximise your tax benefits.

At the end of every financial year, you need to conduct an annual GST audit. Our software helps you prepare and file GSTR-9 and GSTR-9C. These returns are essential for reconciling your accounts and GST filings. This gives you an overview of your annual GST transactions and ensures compliance.

It’s important to understand the difference between GSTR-1 and GSTR-3B for effective GST management. GSTR-1 focuses on sales reporting, while GSTR-3B provides a summary of both sales and purchases, detailing the tax paid on sales. Knowing when and how to file each form can significantly affect your financial reporting and compliance.

GSTR-2A and 2B help you track your eligible Input Tax Credit (ITC). GSTR-2A shows the auto-generated purchase details from your suppliers’ sales data. Further, GSTR-2B gives a snapshot of the available credit at the end of the month. It helps you compare GSTR 2A and 2B with ITC, where if the client’s invoices don’t match with the invoices filed on the GST Portal could be checked and reconciled.

Explore the best features of GSTR Filing Software

Simplified GST Return Filing

With WebLedger’s user-friendly GST return filing software, you can smoothly file GSTR-1, GSTR-3B, GSTR-4, GSTR-9, and GSTR-9C. Experience the best GST software for return filing in India.

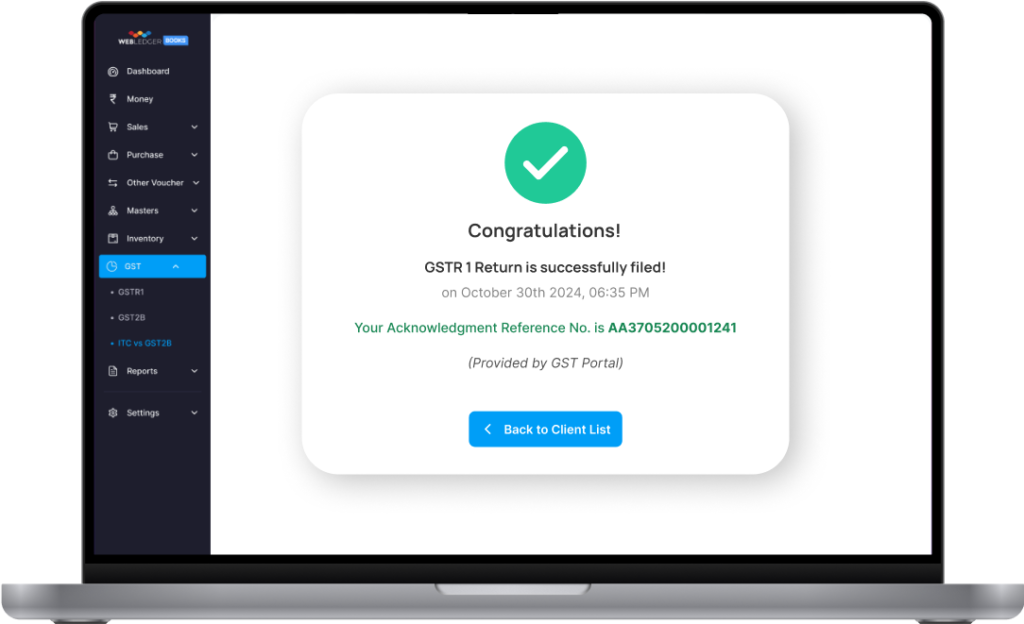

File GSTR-1 & 3B in Just 3 Clicks

Our GST file return software simplifies your filing process, making it fast and error-free. All you have to do is click three times, and your GSTR-1 and GSTR-3B get filed quickly, highly enhancing your tax compliance effectiveness. Automation prevents you from making manual errors and ensures you receive an accurate input tax credit.

Simple Reconciliation of GSTR-2A, 2B, and ITC

Unleash the maximum potential of our GST audit software. Find in-depth insights into your compliance by easily comparing your GSTR-2A and 2B with your ITC records. The simplified process guarantees accurate reconciliation and a comprehensive GST audit. On the best software for GST Filing, explore this feature with ease.

Quick GST Refunds Assistance

Our GST file return software simplifies your filing process, making it fast and error-free. All you have to do is click three times, and your GSTR-1 and GSTR-3B get filed quickly, highly enhancing your tax compliance effectiveness. Automation prevents you from making manual errors and ensures you receive an accurate input tax credit.

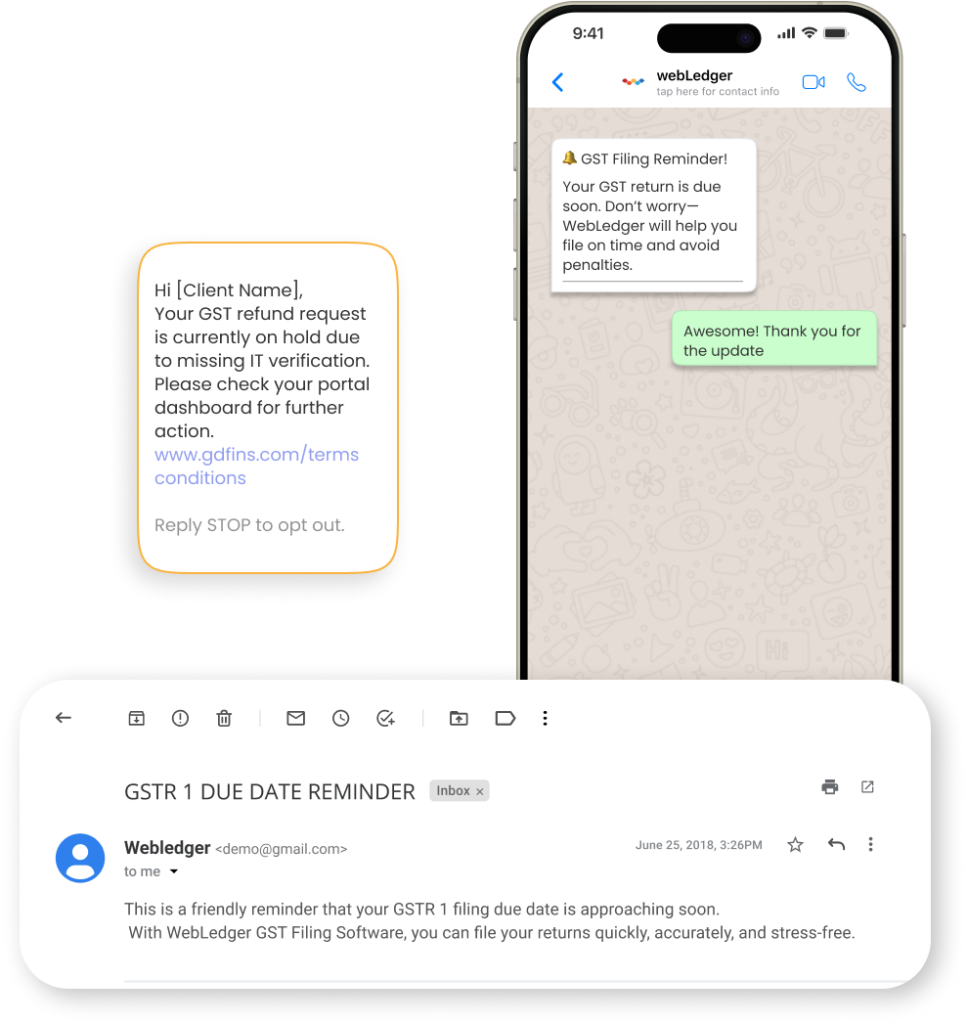

Timely Filing Reminders (WhatsApp, Email)

Never miss a deadline again! WebLedger GST filing software reminds you on time through Email, WhatsApp, or Electronic mail and WhatsApp. This ensures the complete GST filing process is hassle-free and regulatory timelines are met.

Why choose us for GSTR filing?

WebLedger resets simplicity and gives an unparalleled user experience to your GST filing. Try us and you will find the best GST filing software for your practice.

Streamlined Client Management

For tax professionals and CAs, the multi-client support facility of WebLedger enables you to work with multiple GSTINs from a single login, maximising resources and boosting productivity. It is the perfect GST filing software for tax consultants.

Super-Fast GST Filing

Enjoy fast GST filing processes via WebLedger's intelligent automation. We minimise manual intervention and error, turning GST compliance into an easy job. File and download all GST returns in less time.

100% Compliant

Catch up with deadlines using WebLedger's timely notifications. Our software helps you reconcile GSTR-2A, enabling you to ensure compliance and avoid mistakes and fines easily

Complete GST Filing

Our full-fledged GST filing software enables you to file GSTR-1, GSTR-3B, and GSTR-9. Easily view and analyse your financial information to facilitate informed decision-making. Our built-in GST audit functionalities provide an open and accurate audit procedure.

Round-the-Clock Support

Count on WebLedger's support team for help at all times, from implementation to debugging. Your success matters to us.

Made for the World

Focus on what really matters. Deliver exceptional client service.

Frequently Asked Questions

Quick answer to questions you may have.

Is WebLedger easy to use for someone new to GST filing?

Yes, our GST return filing software is simple to use. Even new CAs can navigate it easily and file their returns without trouble.

Can I view my previous GST filings on WebLedger?

Yes, our software lets you access and view all your past GST filings, helping you keep complete records.

How does WebLedger ensure correct input tax credit?

We help you claim the correct input tax credit by making it easy to reconcile GSTR-2A, 2B, and ITC. This is one of the reasons our software is considered top-notch for GST return filing.

Why is WebLedger called the "best GST software for return filing?

WebLedger stands out because of its fast filing, built-in compliance checks, dedicated support, and strong security, all of which create a smooth GST filing experience.

Does WebLedger offer more than just return filing features?

Yes, besides filing returns, WebLedger also includes client management, reconciliation, and audit support. Thus, this makes it a comprehensive GST solution.

Can I use WebLedger from different devices?

Yes, because it is cloud-based, you can access WebLedger’s GST filing tool from any device with internet access.

How does WebLedger keep me compliant with changing GST rules?

WebLedger is always updated with the latest GST regulations. This ensures that you remain fully compliant.

What support can I get if I have a problem?

WebLedger provides ongoing support from our team of experts. They are available to help you with any questions or issues during your GST filing.

How does WebLedger protect my financial information?

We use strong security measures to keep your financial data safe, so you can use our platform with confidence.

How does WebLedger price?

We offer clear, scalable plans for our GST filing software. You only pay for the features your business needs.

Streamline Your Business Today!

Discover the all-in-one solution for Accounting, Office Management, and CRM. Simplify tasks, boost efficiency, and grow smarter.