GST Reports Made Easy Smart, Fast & Fully Compliant

Say goodbye to manual calculations and compliance stress. With our GST accounting software, you get a complete solution to manage billing, reporting, and returns—all in one place. Whether you’re a growing business or a seasoned professional, our cloud-based system is designed to simplify your GST journey.

Please enter the OTP below to proceed.

Integrations on Demand

Customize Integrations as per Customer Requirements

File GST Returns Faster. Smarter. Free with WebLedger.

Say goodbye to lengthy forms and confusing processes. With WebLedger, you can file GSTR-1, GSTR-3B, GSTR-4, GSTR-9, and GSTR-9C in just a few clicks. Save time, reduce errors, and focus on growing your business not paperwork.

Why is it the Best GST Billing and Accounting Software?

Auto GST Billing with HSN/SAC Integration

Smart Sales & Purchase Bill Book

GSTR-1 Report: Outward Supplies at a Glance

- B2B and B2C invoices

- Nil-rated invoices

- Credit/Debit notes

- HSN/SAC summary

- Total taxable value, IGST, CGST, SGST, Cess, and invoice totals

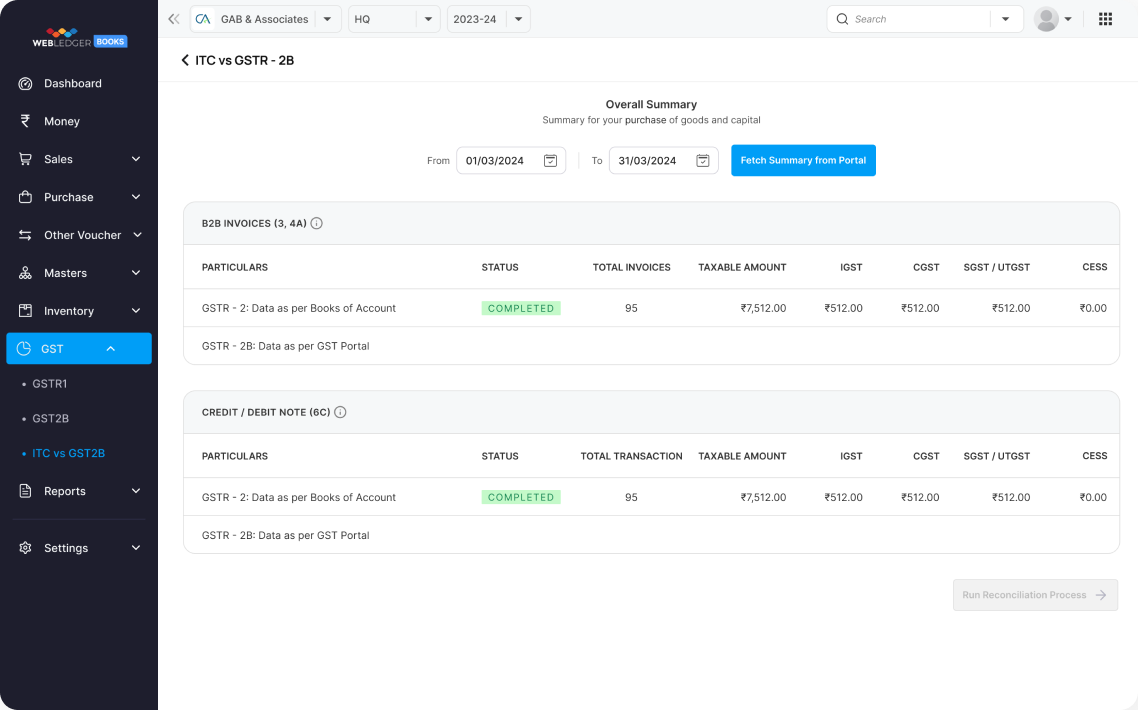

GSTR-2B Report: Purchases & ITC Simplified

- Input Tax Credit (ITC) Available

- ITC Not Available

- ITC Reversal

- All records in one dashboard This feature makes it a powerful online GST accounting software for tracking and optimising your ITC.

GSTR-3B Report: Net GST Liability Made Clear

- Net ITC Available

- Amount to be paid

- Carry forward and set-off details

Made for the World

Focus on what really matters. Deliver exceptional client service.

Trusted by top brands

We speak with our powerfull statistics

Benefits of Using Our GST Accounting Solution

Unlock smarter compliance and effortless reporting with a solution that’s built for speed, accuracy, and peace of mind. Here’s how our platform helps you stay ahead

Automated GST Billing & Calculations

Say goodbye to manual errors. Our GST accounting software auto-calculates GST based on HSN/SAC codes and state details, ensuring every invoice is accurate and compliant.

Faster Invoicing with Smart Bill Book

Create and manage sales and purchase bills in seconds. As a trusted GST bill book software, it helps you maintain organised records and streamline your billing process.

Effortless GST Return Filing

Generate GSTR-1, GSTR-2B, and GSTR-3B reports automatically. With the best GST-ready accounting software, you get government-approved formats and complete summaries—without the hassle.

Seamless ITC Tracking

Fetch purchase data directly from the GST portal and view your Input Tax Credit status in one place. Our online GST accounting software helps you maximise ITC and avoid missed claims.

Accurate Tax Liability Calculation

Get a clear view of your net GST payable, carry forward amounts, and set-offs. This makes our solution the best GST billing and accounting software for monthly tax planning.

Cloud-Based Convenience

Access your GST reports anytime, anywhere. As a modern GST management software, it’s built for professionals who need flexibility and control on the go.

Frequently Asked Questions

Quick answer to questions you may have.

What is GST accounting software, and how does it help?

WebLedger’s GST accounting software helps you manage GST billing, reporting, and return filing in one place. It auto-calculates GST based on HSN/SAC codes and state info, saving you time and reducing errors.

Why is this considered the best GST ready accounting software?

Because it automates everything – from invoice creation to GSTR-1, GSTR-2B, and GSTR-3B reports. It’s fast, accurate, and fully compliant with government formats, making it ideal for professionals and businesses.

Can I generate GST bills using this software?

Yes! Our GST bill book software lets you create sales and purchase bills instantly. Just enter the product or service details, and the system calculates GST automatically.

What makes this the best GST-ready accounting software?

’s built to match government-prescribed formats for all GST reports. You can generate GSTR-1, GSTR-2B, and GSTR-3B with zero manual effort—keeping you compliant and stress-free.

Is this an online GST accounting software?

Yes. You can access it from anywhere, anytime. It’s cloud-based, so you don’t need to install anything—just log in and start managing your GST.

How does the software handle Input Tax Credit (ITC)?

Our GST management software fetches purchase data directly from the GST portal. You’ll see ITC Available, ITC Not Available, and ITC Reversal—all in one dashboard.

Can I track my monthly GST liability?

Yes. The software auto-generates your GSTR-3B report, showing the net GST payable, carry forward amounts, and set-offs. It’s perfect for monthly tax planning.

Is this software suitable for small businesses and startups?

Definitely, it’s easy to use—even for non-accountants. Whether you’re a freelancer, SME, or CA, this GST accounting software adapts to your needs.

What kind of reports can I generate?

You can generate GSTR-1 (sales), GSTR-2B (purchases & ITC), and GSTR-3B (monthly tax summary). All reports follow government formats and include detailed summaries.

How do I get started?

Just book a demo or sign up for a free trial. Experience the best GST billing and accounting software that simplifies your entire GST process—from billing to reporting.

Streamline Your Business Today!

Discover the all-in-one solution for Accounting, Office Management, and CRM. Simplify tasks, boost efficiency, and grow smarter.