Section 194C TDS on Contractor Payment: Rates & Limits

Section 194C TDS on Contractor Payment

Section 194C of the Income Tax Act, 1961, addresses Tax Deducted at Source (TDS) on payments to contractors and sub-contractors. This section ensures that tax is collected on time by making the payer deduct tax before making certain payments for work contracts. The term “contract” under Section 194C also covers sub-contracts, meaning payments to sub-contractors are also subject to TDS. This is one of the most commonly applicable TDS rules for businesses and individuals involved in contractual work.

Meaning of Contractor and Work under Section 194C

Who is a Contractor and Sub Contractor?

A contractor is anyone who makes a contract with another person to do specific work for payment. A sub-contractor is someone who completes all or part of the work given by the contractor.

What is Considered ‘Work’?

Under Section 194C, the term work includes:

- Advertising

- Broadcasting and telecasting (including production of programs)

- Carriage of goods or passengers (excluding railways)

- Catering services

- Manufacturing or supplying a product using material provided by the customer

- Any construction, repair, or maintenance work

Note : Manufacturing or supplying a product with material bought from a third party (not provided by the customer) is not included in the definition of “work” under Section 194C.

For Eg – Mr. A places an order for buying finished goods to Mr. B. Mr. B buys raw material on his own, from a third party, and manufactures the product. The product is then sold to Mr. A. Hence, the nature of the transaction is not a works contract rather it is sale of goods, and thus 194C will not be applicable.

Webledger

Please enter the OTP below to proceed.

Who is Required to Deduct TDS under Section 194C

TDS on contractor payment under Section 194C must be deducted by the following persons when making payment to Contractor:

1. Government & Public Bodies

These include:

- Central Government or State Government

- Local authorities, such as municipalities and panchayats

- Corporations established by a Central or State law

- Authorities created for housing, urban planning, or city development

- Universities and deemed universities

- Foreign governments or foreign enterprises

All these bodies must deduct TDS on contractor payments.

2. Business & Organisational Entities

These include:

- Companies

- Partnership firms

- Co-operative societies

- Trusts

- Registered societies

All these entities must deduct TDS, no matter their turnover.

3. Individuals, HUFs, AOPs, and BOIs (With Conditions)

Individuals, Hindu Undivided Families (HUF), Associations of Persons (AOP), and Bodies of Individuals (BOI) must deduct TDS only if they meet two conditions. First, they should not fall into the categories mentioned above. Second, their accounts had to be audited under Section 44AB in the previous financial year.

This usually applies when either of the following occurred:

- Business turnover exceeded Rs.1 crore (Rs.10 crore if cash receipt/payment is less than or equal to 5%)

- Professional receipts exceeded Rs.50 lakh (Rs.75 lakh if cash receipt/payment is less than or equal to 5%)

Condition-Based Applicability of Section 194C

- Payment is to be made to a resident person.

- Payment must be for work done on contract basis

- Payment must be made by a specific person mentioned in this section.

- The contract value must cross the threshold limits.

- This applies to both the contractor and subcontractor. The contractor becomes a deductor when paying to a subcontractor.

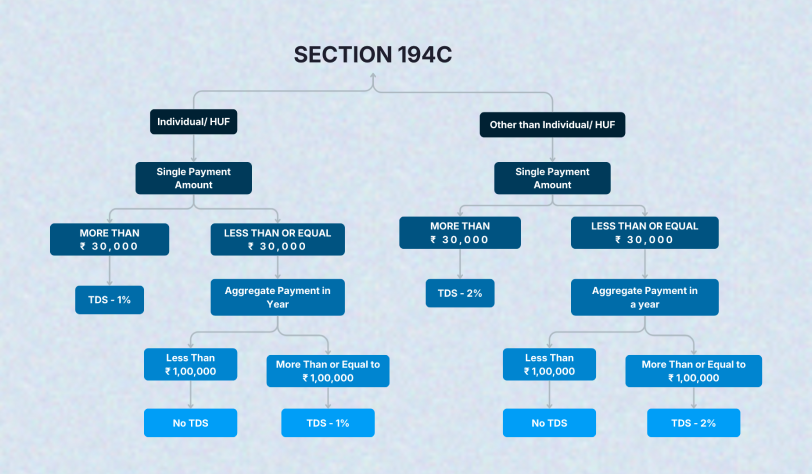

Section 194C TDS Rates

The rate of TDS depends on the nature of the contractor:

| Type of Payee | TDS Rate (in percentage) |

| Individual or HUF contractor | 1% |

| Other contractors (company, firm, etc.) | 2% |

| Payment to transporter | Nil (subject to Section 194C(6) conditions) |

If the contractor or transporter does not furnish a valid PAN to the payer, TDS is deducted at a higher rate of 20%.

Section 197 allows contractors to collect less or no TDS when deduction is higher than their actual tax liability, subject to approval by the Assessing Officer.

Threshold Limits for TDS Deduction under Section 194C

TDS under Section 194C is needed only if:

- A single payment exceeds Rs.30,000/- per contract or payment, or

- The total payment in a financial year exceeds Rs.1,00,000/-

Some clarifications regarding threshold limit

1. For Single Payment Limit: If Payment amount is

- Rs. 30,000 = TDS not applicable

- Rs. 30,500 = TDS Applicable

2. If the limit of Rs.1,00,000/- is exceeded in the middle of the year, TDS will be deducted from the payment when the limit is exceeded.

For eg:

| Payment Month | Amount | Total | TDS Applicable |

| May | 25,000 | 25,000 | No |

| June | 30,000 | 55,000 | No |

| July | 30,000 | 85,000 | No |

| August | 25,000 | 1,10,000 | Yes (on Rs. 25,000) |

Deduction on “Suspense Account” Credits (Section 194C(2))

If the amount payable to a contractor is credited to a suspense account or any other account, it is deemed to be credited to the contractor, and TDS under Section 194C must still be deducted.

Special Rule for Manufacturing Using Customer’s Material (Section 194C(3)

When work involves manufacturing or supplying goods using material provided by the customer:

- TDS on labour charges is deducted only on the labour portion, not on material cost

- If material value is shown separately in the invoice, TDS on labour charges applies only on labour

- If not shown separately, TDS applies on entire invoice value

Contractor TDS on Composite Supply

When contract work involves supply of material (material purchased from 3rd party) TDS is required to be deducted on the entire payment including material cost, if material cost is not charged separately in invoice.

For Eg:

- ABC Ltd. gives a contract to XYZ Contractors for construction of a factory building.

- The contractor purchases cement, steel, bricks, sand, etc. from third parties. ABC Ltd. does not supply any material.

- The contract is a composite works contract (material + labour).

- XYZ Contractor raises invoice of Rs. 20,00,000, without showing separate value of material and labour.

- Hence, TDS must be deducted on the entire payment of Rs. 20,00,000.

- If the contract is to provide labour service only and value of material used is shown separately in the invoice TDS is applicable on service portion only. Clear segregation of material value in the invoice is essential to avoid TDS on such portions.

For Eg:

- ABC Ltd. gives a contract to XYZ Contractors for plastering work.

- The contractor purchases cement and sand from third parties at Rs. 1,00,000.

- The contract is a composite works contract (material + labour).

- XYZ Contractor raises invoice of Rs. 20,00,000, charging

- Rs. 19,00,000 for labour charges for plastering

- Rs. 1,00,000 for cement and sand

- Hence, TDS will be deducted only on the labour charge portion of Rs. 19,00,000.

- In the absence of separate material valuation, TDS must be deducted on the full invoice value.

For Eg:

- In the above example if the Contractor raises invoice without proper bifurcation of Labour charge and Raw Material (Cement and Sand), then TDS must be deducted on the entire invoice of Rs. 20,00,000.

Time of Deduction

TDS must be deducted at the earlier of the following two events:

- At the time of credit of the amount to the contractor’s account, or

- At the time of actual payment (cash, cheque, or any other mode)

Section 194C TDS exemptions

Certain TDS on contractor payment are exempt under this section:

- Payments to transport contractors who, at any point in the year, own no more than ten goods carriages and submit a declaration and PAN (where payments are made to transport contractors without TDS under Section 194C(6), the payer is required to furnish prescribed details to the Income Tax Department within the specified time).

- Individuals’ or HUFs’ personal payments, but their TDS may be deducted under section 194M

- Payments made below the designated thresholds

Deposit of TDS and Filing of Returns

| Payer Type | Payment Month | TDS Deposit Date |

| Government or payment on behalf of government | Any Month | Same date of payment |

| Other than Government | All month other than March | 7th of the following month |

Note: For TDS deducted in March, the due date is 30th April

- Quarterly TDS returns must be filed in Form 26Q

- TDS certificates are issued to contractors in Form 16A

Consequences of Non-Compliance

Failure to comply with Section 194C may lead to:

- Interest for late deductions or late payments may result from noncompliance with Section 194C TDS.

- Penalties for failing to make a deposit or deduction

- Expenditure disallowance when calculating taxable income

- Further examination and notifications from the Income Tax Department

Importance of Section 194C for Businesses

In contract work, Contractor TDS promotes transparency and tax discipline. It helps lower tax evasion by ensuring that contractors’ income is accurately reported and taxed. Businesses can avoid fines and maintain smooth financial operations by adhering to the regulations.

Conclusion

Section 194C is important to the tax system of India, as it controls TDS on contractor payments. Businesses and professionals who deal into contracts should understand its scope, applicable rates, threshold limits, and compliance requirements. Timely deduction and payment of TDS is supported by a transparent tax system. Legal compliance is ensured through accurate computation, and appropriate filing of TDS returns in prescribed forms.