The concept of GST is something everyone needs to familiarise themselves with. GST stands for Goods and Service Tax, which is an indirect tax placed on goods. This has replaced the traditional tax collection methods such as VAT, service tax, excise duty tax, etc. With the passing of the GST Act in 2017, on the 29th of March, and its implementation on the 1st of July of the same year, domestic and international taxation law for the country has undergone a much-needed change.

The GST scheme imposes the tax at each point of sale. Intra-state sales are subject to both Central GST as well as State GST. All interstate sales are subject to the consolidated GST. Let us delve into the nitty gritty of GST and its importance for individuals and businesses.

Understanding GST Basics and its Objectives

Although the evolution of GST in India has been controlled and slow, the objectives of GST have helped shape the existing tax regime and taken it to new heights. The 5 major objectives behind the implementation of GST are as follows:

-

One Nation, One Tax Scheme

The emergence of GST has ensured the replacement of indirect taxes that existed traditionally. GST makes sure that every state follows the same official rate for any particular product or service. With this method of tax compliance in place, taxpayers are not burdened with a multitude of deadlines and forms, making it a unified system of taxation.

-

Improvement in Logistics and Business

One tax system reduces the existence of multiple documentation. With the help of GST, the supply chain and turndown time, and warehouse consolidation is improved. This helps in minimizing logistics as well as warehousing costs.

-

Providing Competitive Pricing and Increased Consumption

The implementation of GST has also resulted in a rise in consumption and hidden tax collections. Because of the former regime’s tax cascading effect, the prices of items in India were more expensive than in worldwide markets.

-

Eliminating the Cascading Effect of Taxes

One of the major objectives of GST has been to remove the cascading effect of tax. Earlier, taxpayers were unable to set off tax credits, which led to a cascading effect. However, the GST tax is solely levied on the net additional value at each level of the supply chain, which has contributed to the seamless flow of taxes.

-

Restricting Tax Evasion

GST Laws are quite strict compared to any other tax laws the country has witnessed. Only on those invoices uploaded by their specific supplies, taxpayers can claim an input tax credit. This system has ensured the minimisation of fake claims resulting in an efficient way to curb tax evasion.

Navigating GST for Businesses

Navigating GST is a crucial aspect for all businesses seeking to thrive in the current economic landscape. GST has transformed the ways of operation for businesses by replacing the complicated ways of dealing with indirect taxes. Therefore, the successful navigation of intricacies posed by GST needs an understanding of the different business operations.

Understanding the nuances of GST helps individuals make informed decisions about purchasing and selling since they can readily assess tax implications on various products and services. You need to know the rates of GST that enable you to effectively plan your finances.

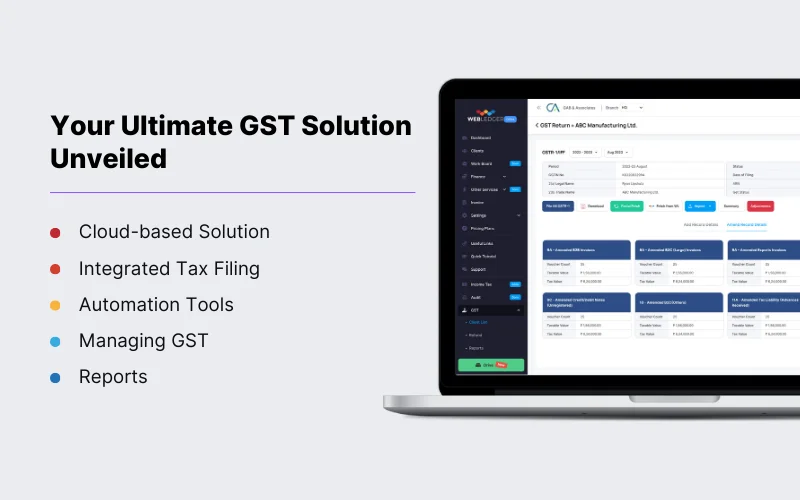

Why choose WebLedger for all GST needs?

The emergence of GST in India brought about a major shift in the working of businesses and individuals. This helped minimize confusion surrounding the tax system. Not only simplifying taxes, the other benefits such as tax evasion, boosting the logistics sector, and minimising tax burden, are some commendable features of GST. However, for the average person handling individual finances or a business, it can be difficult to understand the processes of taxes and the rules controlling them, from the get-go. This is where WebLedger can help! With its integrated tax filing software and automation tools, managing GST and other filing-related processes is now easier than ever!

Conclusion

GST is a technologically driven system that allows activities such as gst return filing software, registration, refund application, and so on, to maintain a rigid and moderated taxation system. GST also helps to integrate the tax rate of the country, uniformly to improve the collection of taxes and boost the development of the economy by removing indirect taxes between states. With the help of WebLeger and its tools, all businesses as well as individuals will be able to comply with GST rules to avoid any penalties or losses. Furthermore, WebLedger can also help in remaining up to speed on GST framework modifications and revisions, which is critical for adjusting plans and improving financial operations.