Technology has overtaken the operation of business, the ways and practices, with every now and then updates in the technology advancement. It has played a major role in redeveloping the whole way, replacing or reshaping traditional practices. One such area experiencing a profound transformation is bookkeeping, the cornerstone of financial management. With the use of automation technologies, the bookkeeping process has witnessed a revolutionising behaviour, especially in the way businesses handle their financial data, streamlining processes, minimising errors, and opening new levels of efficiency. This blog talks about the various ways automation is transforming Account bookkeeping processes and how important it is for the advantages it brings to businesses.

Streamlining Bookkeeping with Technology

- Accuracy and Error Reduction:

Manual data entry is susceptible to human errors, leading to discrepancies in financial records. Automation in bookkeeping minimises the risk of errors by eliminating the need for manual input. Advanced algorithms and machine learning technologies ensure that data is accurately recorded, reducing the likelihood of costly mistakes and enhancing the overall reliability of financial information.

- Time Efficiency and Increased Productivity:

Automated bookkeeping processes significantly reduce the time spent on routine tasks. Mundane activities such as data entry, reconciliation, and categorization can be performed much faster with automation, allowing bookkeepers to focus on more strategic and value-added activities. This not only increases productivity but also enables finance professionals to contribute more meaningfully to the overall financial health of the organisation.

- Real-Time Financial Insights:

Automation provides the capability to generate real-time financial reports and insights. With up-to-the-minute data, businesses can make more informed decisions, react promptly to market changes, and adjust their financial strategies accordingly. This agility is particularly crucial in today’s dynamic business environment, where rapid decision-making can be a key differentiator.

- Enhanced Compliance and Security:

Adhering to financial regulations and ensuring data security are paramount in bookkeeping. Automation solutions often come equipped with built-in compliance checks, reducing the risk of non-compliance and associated penalties. Additionally, automation enhances data security by implementing advanced encryption and access controls, safeguarding sensitive financial information from unauthorised access.

- Cost Savings:

While the initial investment in automation tools and cloud based accounting software may seem significant, the long-term benefits translate into substantial cost savings. Automated bookkeeping processes require fewer man-hours, reducing labour costs and the potential for overtime expenses. Moreover, the decreased likelihood of errors and subsequent financial discrepancies can prevent costly audits and regulatory fines.

- Scalability and Adaptability:

Automation in bookkeeping is scalable to the size and needs of the business. Whether a small startup or a large enterprise, organisations can tailor their automated systems to handle specific volumes of transactions and data. This scalability ensures that as businesses grow, their bookkeeping processes can seamlessly adapt without the need for a complete overhaul.

- Integration with Other Systems:

Automation facilitates seamless integration with other business systems, such as Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) software. This interconnectedness streamlines data flow across different departments, eliminating silos and fostering a more holistic approach to financial management.

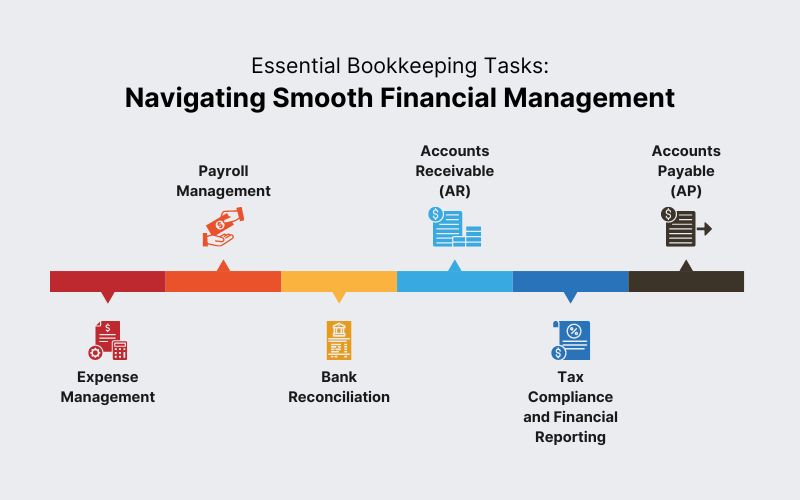

Technology Helping Transform Bookkeeping Tasks for Smooth Financial Management

- Expense Management:

Automating expense management streamlines the cumbersome task of collecting and tracking receipts. By eliminating the need for paper receipts, the process becomes efficient. CA office management software simplifies receipt uploading through snapshots, matches data from corporate credit cards to receipts, and facilitates an easy approval process. Some platforms even directly communicate with finance team systems, automating expense data forwarding for seamless bookkeeping.

- Payroll Management:

Among the most time-consuming bookkeeping tasks, payroll management becomes highly automatable. Automation calculates net pay for employees, facilitates one-click paycheck disbursement, and seamlessly inputs data into the accounting system. Business accounting software with built-in payroll automation tools or dedicated payroll solutions can efficiently handle these processes.

- Bank Reconciliation:

Bank reconciliation, a critical accounting task, becomes more efficient through automation. The tool checks records against bank statements, quickly matching books and bank statements. It flags missing or double entries, rectifies inconsistencies within cash records, and even detects fraud in real-time through periodic reconciliations. Most top online accounting software offers this as a primary feature.

- Accounts Receivable (AR):

Automating AR enhances the lifeblood of businesses by accurately generating invoices against sales records, expediting approvals, and issuing prompt payment reminders to customers. Dedicated accounts receivable tools simplify revenue collection and can automatically pull reports from previous unpaid invoices.

- Accounts Payable (AP):

AP management, involving bills and payments owed to others, benefits significantly from automation. It centralizes bill collection, initiates auto-matching of deliveries against bills, automates approval processes, and triggers payments to suppliers. Configuring AP within accounting software ensures seamless integration and efficiency.

- Tax Compliance and Financial Reporting:

Automation in tax compliance and financial reporting goes beyond transactional tasks. It updates taxes based on region and rates, prepares tax returns, generates financial statements, and predicts future revenue. Full-stack modern cloud accounting software or dedicated reporting applications, integrated with larger accounting systems, simplify and enhance the accuracy of these complex processes.

Challenges with Manual Data Entry

Manual data entry in bookkeeping comes with a set of challenges that can impact the accuracy and efficiency of financial records. These challenges include:

Human Errors:

Typographical Mistakes: Simple errors such as typos or keystroke mistakes can lead to significant inaccuracies in financial data.

Transposition Errors: Reversing the order of numbers or digits can result in miscalculations and distort the true financial picture.

Data Entry Mistakes: Incorrectly inputting numerical values or information can lead to discrepancies in calculations and reporting.

Time-Consuming Nature:

Labor-Intensive Tasks: Manual data entry is a time-consuming process, especially when dealing with a large volume of transactions. This can slow down the overall bookkeeping process.

Resource Intensity: Assigning personnel solely for data entry consumes valuable resources that could be utilized for more strategic financial activities.

Prone to Delays:

Reporting Lags: The manual input of data often results in delays in generating financial reports. This lag can hinder timely decision-making and responsiveness to market changes.

Reconciliation Challenges: The time required for manual reconciliation of accounts can lead to delays in identifying and rectifying discrepancies.

Inconsistency Across Entries:

Variability in Formatting: Inconsistent formatting of data, such as date formats or currency symbols, can create confusion and make it challenging to conduct accurate analyses.

Lack of Standardization: Without standardized processes, different individuals may use varied methods for data entry, leading to inconsistencies.

Limited Scalability:

Manual Limitations: As the volume of transactions increases, manual data entry becomes more prone to errors, and the process becomes increasingly challenging to scale.

Risk of Overlooked Entries: The sheer volume of data can result in oversight, with entries potentially being missed or inaccurately recorded.

Dependency on Individual Skillsets:

Training Requirements: The effectiveness of manual data entry depends on the skill and training of the individuals performing the tasks.

Staff Turnover Impact: High turnover rates or changes in personnel can disrupt the continuity and consistency of data entry practices.

Security Concerns:

Data Vulnerability: Manual processes may lack the security measures present in automated systems, increasing the risk of data breaches or unauthorised access.

Limited Audit Trail: Manual entry may not provide a comprehensive audit trail, making it challenging to trace the origin of errors or discrepancies.

Reduced Focus on Analysis:

Diverted Attention: The time and effort invested in manual data entry can divert attention away from more analytical and strategic financial tasks.

Missed Opportunities: Limited time for analysis may result in missed opportunities for identifying trends, patterns, or areas for financial improvement.

How Leveraging Technology Minimises Errors

Addressing the challenges posed by manual data entry, automation introduces innovative solutions to enhance accuracy and reduce errors.

- Data Validation Algorithms:

Automation systems incorporate sophisticated data validation algorithms that continuously scrutinize incoming data. These algorithms are designed to detect anomalies, inconsistencies, and errors in real-time. By immediately flagging discrepancies, automation ensures that inaccuracies are addressed promptly, preventing them from propagating through the financial records.

- Machine Learning Technologies:

Machine learning technologies embedded in automation systems bring a dynamic element to error reduction. These systems learn from historical data patterns, adapting to the nuances of different transaction types. As a result, the likelihood of repetitive errors diminishes over time. The continuous learning capability of machine learning contributes to a more accurate and efficient bookkeeping process.

- Elimination of Manual Input:

One of the primary ways automation minimizes errors is by eliminating the need for manual data input. Automation systems can directly integrate with various data sources, reducing reliance on manual entry. This not only speeds up the data input process but also significantly decreases the risk of human errors associated with manual tasks.

- Audit Trails and Accountability:

Automation systems maintain comprehensive audit trails, providing a transparent record of all financial activities. This not only enhances accountability but also facilitates error identification and resolution. In the event of discrepancies, the audit trail serves as a valuable tool for tracking the origin of errors and implementing corrective measures.

How WebLedger’s Technological Advancements Elevate Bookkeeping Efficiency

Financial management, the advent of technology has paved the way for more efficient and accurate bookkeeping processes. WebLedger, with a powerful bookkeeping software, stands out as a catalyst for automating bookkeeping tasks, offering a range of benefits to businesses. Let’s check and understand how WebLedger can revolutionise and streamline your bookkeeping practices.

- Seamless Data Entry:

WebLedger simplifies the often tedious task of data entry by providing an intuitive and user-friendly interface. With features like automatic data capturing and transaction categorization, the software minimizes manual input errors and ensures that financial records are accurately recorded.

- Time Efficiency:

One of the primary advantages of WebLedger is its ability to save time. The automation features significantly reduce the time spent on routine bookkeeping tasks such as reconciling accounts and categorising transactions. This time-saving element allows bookkeepers to focus on more strategic financial analysis and decision-making.

- Real-Time Updates:

WebLedger offers real-time updates and insights into your financial data. This means you can access up-to-the-minute reports, helping you make informed decisions promptly. Whether it’s tracking expenses, monitoring cash flow, or assessing the overall financial health of your business, real-time updates contribute to more effective financial management.

- Enhanced Accuracy:

Automation through WebLedger minimizes the risk of human errors in bookkeeping. The automated accounting software employs advanced algorithms and data validation checks, ensuring that your financial records are precise and reliable. This heightened accuracy can prevent costly mistakes and discrepancies in your financial statements.

- Improved Compliance:

Adherence to financial regulations is crucial, and WebLedger aids in maintaining compliance. The software is designed to incorporate regulatory requirements into its processes, reducing the risk of non-compliance and associated penalties. This feature is particularly valuable for businesses operating in industries with stringent financial regulations.

- Customizable Reporting:

WebLedger provides customizable reporting options, allowing you to tailor financial reports to meet your specific needs. Whether it’s generating income statements, balance sheets, or cash flow reports, the bookkeeping software for accountants empowers you to create reports that align with your business goals and priorities.

- Integration Capabilities:

WebLedger seamlessly integrates with other business systems, fostering a cohesive and interconnected financial ecosystem. Integration with tools such as Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) systems ensures a smooth flow of data across various departments, eliminating data silos and enhancing overall financial management.

Conclusion

The integration of automation technologies is fundamentally reshaping the process of bookkeeping processes. The benefits extend beyond mere efficiency gains, encompassing improved accuracy, enhanced compliance, and real-time insights. As businesses continue to embrace these advancements, the role of the bookkeeper is evolving into that of a strategic financial advisor, contributing significantly to the overall success and growth of the organization. The future of bookkeeping is undeniably automated, and those who embrace this transformation stand to gain a competitive edge in the evolving world of finance.

WebLedger emerges as a key player in automating bookkeeping processes. Its user-friendly interface, time-saving features, real-time updates, and compliance adherence make it a valuable asset for businesses seeking to enhance the efficiency and accuracy of their financial management. WebLedger can lead to a more streamlined, error-free, and responsive bookkeeping experience, ultimately contributing to the financial success of your business.