Efficient financial management is paramount for business growth, necessitating a comprehensive understanding of sound financial practices, including the meticulous maintenance of an accurate and well-organized general ledger. The task has now become pretty easy as there has been an evolution in work, with the implementation of technology and several cloud-based accounting software.

Various options abound for businesses seeking efficient ledger cloud management, with the advent of cloud accountant solutions offering seamless integration and accessibility. Nonetheless, selecting the optimal ledger accounting software remains a challenging endeavor that requires careful consideration.

The general ledger serves as the cornerstone of a company’s financial records, housing a comprehensive log of all financial transactions. From sales and purchases to expenses and revenues, every transaction finds its place within the ledger’s meticulous accounts. When businesses grow, managing the general ledger becomes a hectic complex task and one needs online accounting software.

Notably, a general ledger is the base of a company’s financial records. The ledger cloud is a complete record of all financial transactions, which can be done with several having organized account bookkeeping. Every transaction, irrespective of whether it’s a sale, purchase, expense, or revenue, is recorded in the general ledger.

In this blog post, we will explore the essentials of general ledger accounting, and discuss the features. We’ll also unfold what to look for in ledger software, compare cloud-based vs. on-premise solutions, and introduce you to a leading cloud accounting software solution – Wedledger.

What is a General Ledger?

The general ledger serves as the central repository for all financial transactions within a company. Think of it as a detailed record book where every financial event, no matter how small or significant, is recorded and categorized.

Here’s a breakdown of its key components and functions:

- Accounts: The general ledger consists of various accounts, each representing a different aspect of the company’s finances. Common accounts include assets (like cash, inventory, and property), liabilities (such as loans and accounts payable), equity (ownership stake), revenue (income generated from sales or services), and expenses (costs incurred to run the business).

- Double-Entry System: Transactions are recorded using a double-entry accounting system, which means that every transaction affects at least two accounts: one account is debited (increased) and another is credited (decreased). This ensures that the accounting equation (Assets = Liabilities + Equity) remains balanced at all times.

- Transaction Recording: When a financial transaction occurs, it is recorded in the general ledger using journal entries. Each entry includes details such as the date, description of the transaction, accounts affected, and the corresponding monetary amounts.

- Posting to Ledger Accounts: After journal entries are recorded, they are posted to the appropriate ledger accounts in the general ledger. This process involves transferring the information from the journals to the respective accounts and updating their balances accordingly.

- Summarization and Reporting: The general ledger serves as the foundation for preparing financial statements such as the balance sheet, income statement, and cash flow statement. These statements provide valuable insights into the company’s financial performance, position, and cash flows over a specific period.

- Analysis and Decision-Making: By examining the information in the general ledger, stakeholders can assess the company’s financial health, identify trends, detect errors or discrepancies, and make informed decisions about resource allocation, investments, and strategic planning.

General Ledger Accounting: The Basics

- Recording Transactions: The first step in general ledger accounting is to record transactions accurately as they occur. This involves creating journal entries that document the details of each transaction, including the date, description, accounts affected, and monetary amounts. For example, when a company makes a sale, a journal entry would be created to record the revenue earned and any related expenses or liabilities.

- Classifying Transactions: Once transactions are recorded, they need to be classified correctly to ensure they are allocated to the appropriate accounts in the general ledger. This step involves identifying whether a transaction impacts assets, liabilities, equity, revenue, or expenses. Proper classification is crucial for accurate financial reporting and analysis.

- Posting to Ledger Accounts: After journal entries are prepared and reviewed, they are posted to the corresponding ledger accounts in the general ledger. Each account in the ledger represents a specific financial category, such as cash, accounts receivable, accounts payable, or retained earnings. Posting involves transferring the information from the journal entries to the appropriate ledger accounts, updating their balances accordingly.

- Adjusting Entries: In addition to regular transactions, adjusting entries may be necessary to ensure that the financial statements reflect the true financial position of the company at the end of the accounting period. Adjusting entries are made for items such as accrued expenses, prepaid expenses, depreciation, and unearned revenue. These entries help align revenues and expenses with the period in which they are incurred or earned, in accordance with the matching principle.

- Generating Financial Reports: The general ledger serves as the basis for preparing various financial reports, including the balance sheet, income statement, and cash flow statement. These reports provide stakeholders with valuable insights into the company’s financial performance, position, and liquidity. By summarizing the information from the general ledger, financial reports enable management, investors, creditors, and other stakeholders to assess the company’s financial health and make informed decisions.

General Ledger Software Features

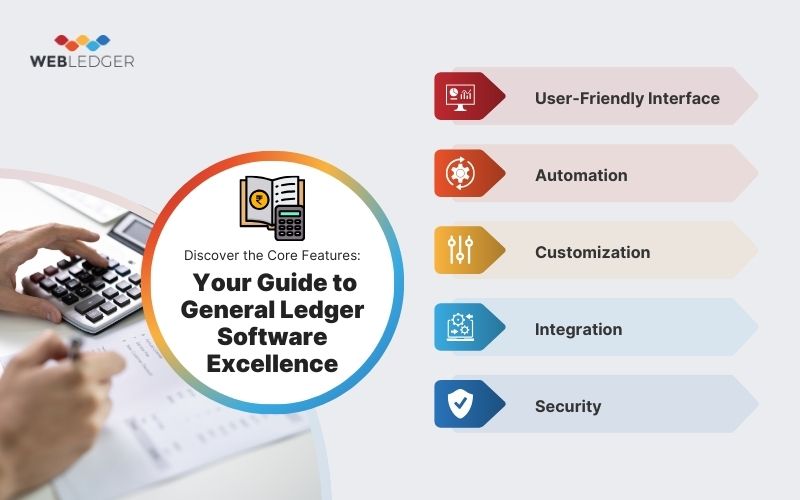

Selecting the right ledger accounting software for your business is a critical decision that can significantly impact your financial operations. To ensure you make the best choice, it’s essential to carefully consider the features that align with your specific needs including Cloud-Based Accounting Software. Here’s an elaboration on some key features to look for:

- User-Friendly Interface: A user-friendly interface is paramount to ensure that your team can easily navigate the software and input financial data without encountering significant learning curves. Look for intuitive design, clear navigation paths, and helpful tooltips or guides to streamline the user experience.

- Automation: Efficiency is key in modern accounting practices. Look for software that offers robust automation capabilities, allowing you to automate routine tasks such as journal entries, bank reconciliations, and recurring transactions. Automation not only saves time but also reduces the likelihood of manual errors, improving overall accuracy.

- Customization: Every business has unique accounting requirements. Ensure the software you choose offers ample customization options, allowing you to tailor the chart of accounts, reports, and dashboards to meet your specific needs. The ability to customize workflows and templates can greatly enhance efficiency and adaptability.

- Integration: Seamless integration with other essential systems is crucial. Look for accounting software that offers integration with other key business systems such as CRM, inventory management, and payroll. This ensures smooth data flow across various departments and eliminates the need for manual data entry or reconciliation.

- Security: Protecting sensitive financial information is non-negotiable. Choose software that prioritizes security with robust features such as data encryption, role-based access control, and regular data backups. Additionally, ensure the software complies with relevant industry regulations and standards to mitigate security risks effectively.

Cloud-based General Ledger Software

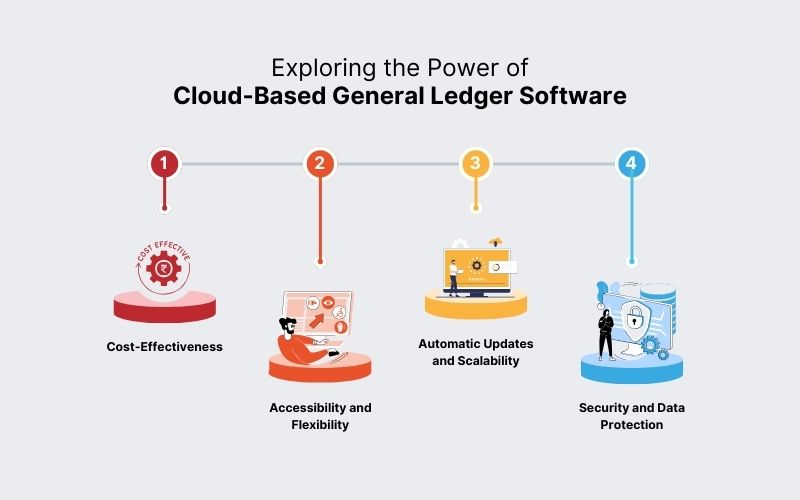

- Cost-Effectiveness: Cloud-based ledger software eliminates the need for costly upfront investments in hardware infrastructure and software licenses. Instead, businesses typically pay a subscription fee based on usage, making it a more cost-effective option, especially for small and medium-sized enterprises (SMEs) with limited budgets.

- Accessibility and Flexibility: With cloud accounting, financial data is stored securely on remote servers and accessible via the internet from anywhere, at any time, and on any device. This level of accessibility enables real-time collaboration among team members, allowing for quicker decision-making and improved workflow efficiency.

- Automatic Updates and Scalability: Cloud software providers regularly update their platforms with new features, enhancements, and security patches, ensuring that users always have access to the latest tools and functionalities without any manual intervention. Additionally, cloud-based solutions offer scalability, allowing businesses to easily adjust their subscription plans and storage capacities as their needs evolve over time.

- Security and Data Protection: Cloud-based ledger software typically employs robust security measures such as data encryption, multi-factor authentication, and regular backups to safeguard sensitive financial information from unauthorized access, loss, or corruption. Reputable cloud providers often adhere to industry-leading security standards and compliance regulations to ensure the highest levels of data protection.

On-Premise General Ledger System

- Greater Control and Customization: On-premise ledger systems offer businesses greater control over their data and infrastructure. Organizations can customize the software to meet their specific requirements and integrate it with other on-premise systems as needed, providing a tailored solution that aligns closely with their unique business processes.

- Data Privacy and Compliance: Some businesses, particularly those operating in highly regulated industries or with strict data privacy requirements, may prefer on-premise solutions for greater control over their data and compliance with industry-specific regulations. By hosting data on internal servers, organizations can ensure adherence to data privacy laws and maintain full ownership and control over their data.

- Dependency on Internal IT Resources: Unlike cloud-based solutions that rely on external service providers for maintenance and support, on-premise ledger systems require dedicated internal IT resources to manage hardware installations, software updates, and technical troubleshooting. This can result in higher operational costs and increased reliance on in-house expertise.

Evaluating General Ledger Systems

- Functionality: Assess the features and capabilities of each general ledger system to ensure it meets your specific accounting needs. Consider factors such as double-entry accounting, bank reconciliation, budgeting, reporting, and integration with other business systems.

- Ease of Use: Choose a system with an intuitive user interface and workflow that aligns with your team’s skill level and familiarity with accounting software. Look for features such as customizable dashboards, easy data entry, and robust search functionalities to enhance usability.

- Scalability: Consider the scalability of the system to accommodate your business’s growth and evolving accounting requirements. Ensure that the software can handle increased transaction volumes, additional users, and expanded functionalities without significant disruptions or performance issues with CA office management software

- Cost: Evaluate the total cost of ownership, including upfront fees, ongoing subscription or licensing costs, implementation expenses, and any additional charges for customization, training, or support services. Compare pricing plans from different vendors to determine the most cost-effective solution for your budget.

- Vendor Reputation: Research the reputation and track record of each vendor to ensure reliability, stability, and quality of service. Look for customer reviews, testimonials, and case studies to gauge user satisfaction and vendor credibility.

How much General Ledger system cost?

- Size of Business: Larger businesses with complex accounting needs may require more advanced features and customization, resulting in higher costs compared to smaller businesses with simpler requirements.

- Number of Users: Most cloud-based solutions price their services based on the number of users accessing the system. As the number of users increases, so does the subscription cost.

- Features Included: The pricing of general ledger systems often correlates with the features and functionalities included in the software package. More comprehensive solutions with advanced features may command higher prices.

- Deployment Model: Cloud-based solutions typically follow a subscription-based pricing model, with monthly or annual fees based on usage and the number of users. On-premise systems may require upfront licensing fees, as well as additional costs for hardware, installation, maintenance, and upgrades.

- Additional Services: Some vendors offer additional services such as implementation support, training, customization, and ongoing technical support for an additional fee. These costs should be factored into the overall budget for implementing and maintaining the system.

Upgrading General Ledger Accounting System

As your business grows and evolves, it’s essential to periodically evaluate and upgrade your general ledger accounting system to ensure it continues to meet your needs. Whether you’re transitioning from manual spreadsheets to automated software or upgrading to a more robust solution, careful planning and implementation are key to a successful transition.

- Business Growth: As your business expands, your accounting needs become more complex. An upgraded general ledger system can provide the scalability and advanced features required to manage increased transaction volumes, additional users, and more sophisticated reporting requirements.

- Efficiency and Accuracy: Manual accounting processes are time-consuming and prone to errors. Upgrading to automated software streamlines routine tasks, reduces manual data entry, and improves accuracy, allowing your team to focus on more strategic activities.

- Regulatory Compliance: Regulatory requirements and accounting standards may change over time. Upgrading your general ledger system ensures compliance with evolving regulations, minimizing the risk of non-compliance penalties and financial discrepancies.

- Enhanced Reporting and Analysis: Advanced reporting and analysis capabilities enable deeper insights into your financial data, helping you make informed business decisions. Upgraded systems often offer customizable dashboards, real-time reporting, and predictive analytics tools to support strategic planning and performance monitoring with online accounting.

Planning the Upgrade:

- Assess Current Needs: Evaluate your current accounting processes, pain points, and future business goals to identify the specific requirements for your upgraded general ledger system. Consider factors such as transaction volume, user scalability, integration with other systems, and regulatory compliance.

- Research Options: Research and compare different general ledger software solutions to find the one that best aligns with your needs and budget. Look for features such as automation, customization, scalability, security, and vendor reputation.

- Data Migration: Plan for a smooth transition by ensuring proper data migration from your existing system to the upgraded one. Cleanse and organize your data, test migration processes, and establish backup procedures to minimize the risk of data loss or corruption during the transition.

- Training and Support: Invest in training and support for your team to ensure a successful adoption of the upgraded system. Provide comprehensive training sessions, user guides, and ongoing support to help employees learn how to navigate the new software effectively and maximize its capabilities.

- Testing and Feedback: Conduct thorough testing of the upgraded system before full implementation to identify any issues or discrepancies. Solicit feedback from key stakeholders and end-users to address any concerns and make necessary adjustments to ensure a seamless transition.

Implementation:

- Phased Approach: Consider implementing the upgrade in phases to minimize disruption to your business operations. Start with a pilot phase involving a small group of users to iron out any issues before rolling out the upgraded system to the entire organization.

- Communication: Communicate proactively with employees about the upcoming changes, highlighting the benefits of the upgraded system and providing regular updates throughout the implementation process. Address any concerns or resistance to change through open dialogue and support.

- Monitoring and Evaluation: Continuously monitor the performance of the upgraded system after implementation to ensure it meets expectations and delivers the intended benefits. Solicit feedback from users and stakeholders to identify areas for improvement and optimization.

Webledger – The Leading General Ledger Accounting Software for Your Business

Wedledger is a comprehensive cloud accounting software solution designed to streamline financial management for businesses of all sizes. Say goodbye to old-school accounting methods and use the digital revolution with WebLedger! Comprehensive accounting software offers a wide array of features tailored to meet the diverse needs of modern businesses. Here’s why WebLedger should be your trusted accounting partner:

- Streamlined Cloud Accounting: Experience the efficiency of cloud accounting with WebLedger. Access your financial data anytime, anywhere, simplifying business management.

- Multi-Business Support: Whether overseeing one business or multiple ventures, WebLedger has you covered. Our software seamlessly manages multiple businesses from one platform.

- Centralized Control for Multi-Branch Management: Simplify operations with our centralized multi-branch accounting dashboard. Monitor aggregated reports and data from various branches in real-time, facilitating informed decision-making.

- Effortless GST Compliance: WebLedger streamlines GST filing procedures, enabling direct generation of GSTR 3B and GST-1 from the GST portal, ensuring compliance with ease.

- Automated E-Way & E-Invoicing: Generate e-Way bills and e-invoices effortlessly with WebLedger. Our intuitive tools streamline billing processes, allowing you to focus on core business activities.

- E-Commerce Integration: Seamlessly manage e-commerce transactions with WebLedger’s dedicated accounting software, compatible with top platforms like Amazon and Flipkart.

- Exceptional Inventory Management: Optimize your supply chain with advanced inventory management tools. Track SKUs, generate analytical reports, and maximize profitability with WebLedger.

- Enhanced Data Security: Rest assured knowing your financial information is secure with WebLedger’s access control features. Maintain control over data access, minimizing the risk of unauthorized use.

- Real-Time Performance Insights: Make informed decisions with our interactive dashboard, offering real-time updates on business performance. Drive your business forward confidently with WebLedger.

- Unlimited Cloud Storage: Store files securely in the cloud with WebLedger. Access important documents anytime, anywhere, ensuring seamless data management.

Conclusion

Selecting the best ledger accounting software for your business is a pivotal decision that can shape the efficiency and accuracy of your financial management processes. Whether you opt for a cloud-based solution like Wedledger or an on-premise system, it’s crucial to consider your unique requirements, budget constraints, and long-term objectives.

Using Webledger’s technological advancements and leveraging the features offered by this modern accounting software, businesses can streamline their general ledger management, enhance data accuracy, and gain valuable insights into their financial performance. From user-friendly interfaces and automation capabilities to robust security measures and seamless integration with other business systems, the right ledger software can revolutionize how companies manage their finances.

Ultimately, investing in the right ledger accounting software empowers businesses to make informed decisions, maintain compliance with regulatory standards, and drive sustainable growth. Whether you’re a small startup or a large enterprise, choosing the right software solution lays the foundation for efficient financial management and long-term success.