Cloud accounting software has replaced old age and is now considered as an evolution in financial management. It has replaced and made an enhancement of the old-age traditional practices. In this blog, we will discover the dynamic realm of cloud-based solutions, shedding light on their functionalities, advantages, and the specific needs they address.

This article is a guide, unravelling the intricacies of cloud accounting to delving into the security measures safeguarding sensitive financial data, the blog navigates the nuances of this digital era’s financial tools.

Whether demystifying the factors influencing acceptance or showcasing the best-in-class solutions available in India, this comprehensive guide is your gateway to understanding and harnessing the power of cloud accounting.

What is cloud accounting software?

Cloud accounting software revolutionizes traditional accounting practices by leveraging cloud computing technology. In this innovative approach, all application functions are performed off-site, without any need of installations on individual desktop computers. Users access software applications remotely through the Internet or other networks, facilitated by a cloud application service provider.

The basic advantage of cloud accounting lies in its capacity to liberate businesses from the burdens of software installation and maintenance. Instead, bookkeeping software is hosted on secure remote servers, enabling small business teams to seamlessly store and access accounting systems, reports, and financial documents from any location with an internet connection. This accessibility extends to employees in various departments, remote offices, or branch locations, fostering collaboration and ensuring that everyone operates on the same version of the software and data.

Cloud accounting facilitates multi-user access, allowing simultaneous collaboration and input from different team members. Data is sent to cloud providers, processed securely, and stored remotely, ensuring both efficiency and safety. This streamlined approach not only enhances accessibility but also supports scalability, adapting to the evolving needs of a growing company.

How does cloud accounting software work?

Cloud accounting software revolutionizes financial management for businesses by leveraging secure web-based applications. This innovative system facilitates seamless collaboration and enhanced financial reporting for small business owners and their finance teams. Through internet access, users can tap into key data from various locations, eliminating the need for individual desktop setups.

Automated accounting software is accessible through service providers, allowing users to connect via the Internet or other networks. This accessibility empowers finance teams, accounts receivable, and remote branches to efficiently collaborate and access the same critical financial records, promoting a unified approach to financial management. This unified accessibility not only improves collaboration but also results in significant time and cost savings.

One of the key advantages of cloud accounting is its robust data security features. The software includes built-in measures for data backup and disaster recovery, ensuring that crucial financial information remains secure even in the face of unforeseen events such as fires, natural disasters, or technical issues with individual computers.

What is the need for cloud accounting software?

The need for cloud accounting software stems from the evolving landscape of modern business, where efficiency, accessibility, and security are paramount. Cloud accounting addresses the challenges faced by businesses by providing a flexible and scalable solution. Traditional accounting systems often involve cumbersome on-premises software installations, limiting accessibility and collaboration. In contrast, cloud accounting enables users to access financial data from anywhere with internet connectivity, promoting remote work and collaboration among dispersed teams.

Small business owners benefit significantly from the cost savings associated with cloud accounting. The elimination of the need for individual desktop setups and the centralized nature of cloud-based systems streamline operations, resulting in reduced time and financial investments. This is particularly crucial for startups and growing enterprises with limited resources.

Data security is a top priority in today’s digital landscape, and business accounting software meets this need with robust features such as regular data backups and disaster recovery mechanisms. Businesses can safeguard their financial information against potential risks, including hardware failures, natural disasters, or cyber threats.

The scalability of cloud accounting allows businesses to adapt and grow seamlessly. As companies expand, the software can accommodate increased data volumes and user requirements without the need for extensive IT infrastructure upgrades.

What are the benefits of working with cloud accounting software?

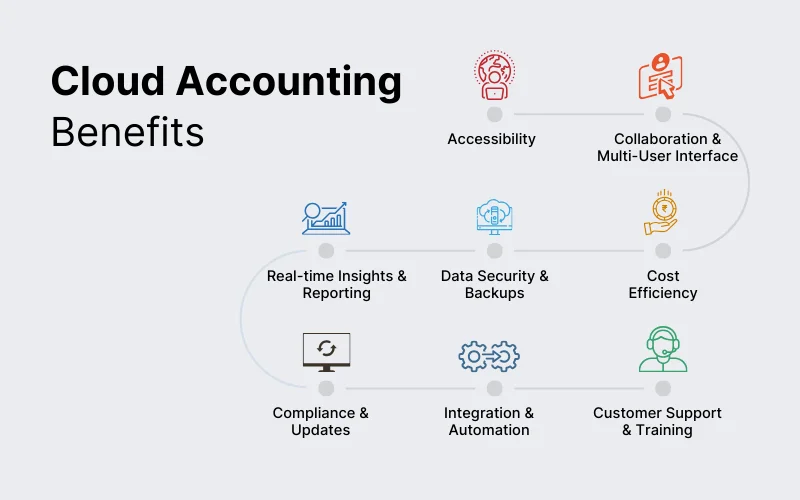

Working with WebLedger cloud accounting software offers a range of advantages, from increased accessibility and collaboration to enhanced security and scalability, empowering businesses to operate more efficiently and effectively. Let us get to know them briefly:

Accessibility: With cloud-based accounting, you can access your financial data from anywhere with an internet connection. This flexibility allows for real-time updates and monitoring, facilitating timely decision-making.

Collaboration & Multi-User Interface: Teams can work concurrently on the same data, enhancing collaboration and teamwork. Multiple users can access and update information simultaneously, streamlining workflows and improving efficiency.

Cost Efficiency: Cloud accounting reduces infrastructure costs associated with maintaining physical servers. Additionally, updates and maintenance are handled by the service provider, saving both time and money.

Data Security & Backups: Cloud-based systems often provide robust security measures, including data encryption and secure backups. This ensures data integrity and protection against data loss due to hardware failures or disasters.

Scalability: As your business grows, cloud accounting software can easily scale up to accommodate increased data and user requirements. You can adjust your subscription or service plan accordingly without significant disruptions.

Real-time Insights & Reporting: These platforms offer advanced reporting tools that provide real-time insights into your financial health. This facilitates better decision-making and strategic planning.

Compliance & Updates: Cloud accounting software often automatically updates to comply with regulatory changes, ensuring that you’re always using the latest version that adheres to tax laws and regulations.

Integration & Automation: Integration with other business applications and automation of repetitive tasks streamline operations. This eliminates manual data entry errors and saves time, allowing focus on more critical aspects of the business.

Customer Support & Training: Cloud accounting services usually offer customer support and training resources to help users maximize the software’s potential and troubleshoot issues efficiently.

Environmental Impact: Utilizing cloud services reduces the need for on-premises hardware, contributing to a smaller carbon footprint and supporting environmental sustainability.

How secure is cloud accounting software?

Cloud accounting software ensures robust security measures, offering businesses a reliable platform for managing sensitive financial data. As businesses increasingly migrate to the cloud, understanding the security features becomes crucial.

Firstly, cloud accounting addresses the vulnerabilities of self-hosted alternatives. Storing data on physical servers in multiple locations provides a safeguard against disasters like fires or floods. Service providers, such as Intuit, implement 24/7 onsite security to protect against unauthorized access.

Automatic backups are integral to cloud security, with systems like QuickBooks Online Advanced performing regular data backups. Multiple copies of data stored in different locations minimize the risk of data loss due to malfunctions or unforeseen events. This ensures data accessibility even in the face of unexpected system issues.

The digital paper trail and encryption further fortify cloud security. Always-on activity logs and audit trails meticulously record user activities and changes to financial transactions. Encryption techniques like 128-bit SSL ensure that data is coded for protection during transmission and storage.

Factors that influence the acceptance of cloud accounting software.

- Compatibility: The seamless integration of a cloud accounting system with the existing technology infrastructure is crucial for successful adoption among SMEs.

- Top Management Support: Leadership support is essential for identifying and addressing technological, organizational, and environmental factors that may affect the successful implementation of cloud accounting systems.

- Technology Readiness: The readiness of software for CA office to integrate into SME operations is a significant consideration, influencing the decision-making process.

- Security Concerns: Concerns about the security of data stored in the cloud play a pivotal role in the decision to adopt cloud accounting systems. Businesses assess the system’s ability to address and mitigate potential security risks.

- Relative Advantage: The perceived advantages of cloud accounting systems, including accessibility, affordability, high-security standards, and ease of use, make them a preferred option over traditional accounting methods.

- Perceived Ease of Use: User-friendly interfaces and features, such as reporting capabilities and robust security, impact the perceived ease of use, influencing the acceptance and utilization of cloud-based accounting systems.

What is the difference between cloud accounting software and traditional accounting software?

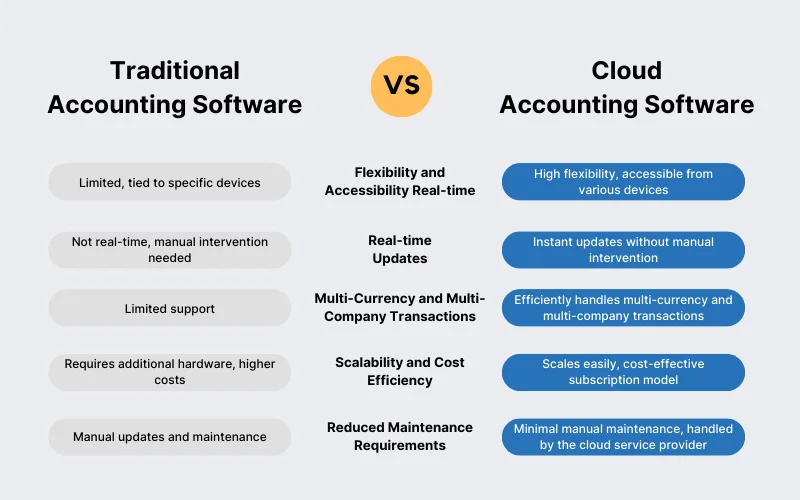

- Flexibility and Accessibility: Cloud accounting offers unparalleled flexibility as accounting data is accessible from any location and on any device with an internet connection. In contrast, traditional accounting software is typically limited to on-premises computers.

- Real-time Updates: CA office management software automatically updates financial information in real-time. This ensures that account balances are consistently accurate, minimizing errors associated with manual data entry. Traditional accounting software may require manual updates and can lag in reflecting the latest financial transactions.

- Efficient Handling of Multi-Currency and Multi-Company Transactions: Cloud accounting solutions are designed to handle multi-currency and multi-company transactions efficiently. This is a significant advantage over traditional software, which may face challenges in managing such complex financial scenarios.

- Scalability and Cost Efficiency: In the traditional on-premises model, business growth often results in increased software license and maintenance costs, necessitating new licenses and fees. Additionally, expansion may require costly purchases of new hardware. Cloud solutions offer scalability without the need for permanent, expensive equipment or significant spikes in costs during expansion or contraction periods.

- Reduced Maintenance Requirements: Cloud accounting requires minimal maintenance compared to traditional accounting software. Cloud providers handle backups, and updates occur automatically without the need for manual intervention. This contrasts with traditional software, where maintenance tasks often fall on the business, including software installations, updates, and backups.

List of the cloud accounting software and tools

- Cloud Accounting Software: Utilized for managing financial transactions, generating invoices, and generating real-time financial reports through web-based applications accessible from any device with internet connectivity.

- Cloud Client Onboarding: Streamlines client onboarding processes by providing cloud-based solutions for document submission, information gathering, and collaboration, ensuring a smooth transition for new clients.

- Client Collaboration Software: Enhances communication and collaboration between accounting professionals and clients by providing a centralized platform for discussions, file sharing, and project management, fostering efficient teamwork.

- E-Signature Tool: Facilitates the electronic signing of documents, eliminating the need for physical signatures. Speeds up approval processes, increases document security, and enhances the overall efficiency of document workflows.

- Practice Management Software: Optimizes workflow and task management for accounting practices. Enables effective tracking of client interactions, deadlines, and project statuses, ensuring a well-organized and streamlined practice.

- Meeting Tools: Supports virtual client meetings, consultations, and team discussions through video conferencing. Enables real-time communication, screen sharing, and collaboration, making remote interactions as effective as in-person meetings.

- File-Sharing Software: Provides secure and accessible cloud-based storage for sharing and collaborating on documents, financial records, and other files. Enhances data accessibility, version control, and overall document management efficiency.

Cloud accounting software available in India

The best accounting automation software ensures multi-device accessibility, allowing users to manage accounts conveniently from anywhere. With a multi-user interface, it fosters teamwork, streamlining collaboration among accounting professionals. In India, WebLedger stands out as a cutting-edge cloud accounting and integrated compliance management software. Offering a user-friendly experience, WebLedger revolutionises financial procedures and compliance tasks. WebLedger provides cutting-edge insights for informed decision-making.

Beyond traditional accounting, WebLedger offers modules such as GST filing, TDS calculation, audit automation, income tax filing, CMA data and project reports, and a versatile workboard for efficient task tracking. Recognized by experts including chartered accountants and CMAs, WebLedger is designed to simplify compliance tasks and reduce the workload for tax professionals.