Simplify Loans - Plan & Analyse Finances, and Secure Loans

Plan Smart, Analyse Finances, and Secure Business Loans with CMA Reports – Simplify Your Growth Journey

Features: to enhance your work experience

CMA Data & Report Generation Module – Features

Comprehensive CMA Data for Loan Assessment

Generate CMA data for business loans, including cash credit, overdraft, and other financial instruments.

Evaluate creditworthiness based on structured financial projections.

MultiYear Financial Projection & Analysis

Input financials from the previous two financial years and the present financial year.

Project financials for the next three financial years to assess future loan eligibility.

Obtain a CMA report determining business credibility for lenders.

Detailed CMA Report Forms for DecisionMaking

Form II – Analysis of Profit & Loss Statement for financial performance evaluation.

Form III – Examination of Balance Sheet for overall financial health.

Form IV – Comparative analysis of current assets vs. current liabilities.

Form V – Computation of maximum permissible bank finance for working capital requirements.

Ratio Analysis – Key financial ratios to determine loan eligibility and borrowing capacity.

Who Can Use It

From Retail to Corporate, Businesses to Professionals, and Small to Enterprise level firms, we provide tailored solutions to various industries, helping each sector grow with our expertise.

Benefits: That your Team can’t miss

Accurate Business Loan Assessment

Helps determine loan eligibility for cash credit, overdraft, and business loans.

Assists in evaluating how much financing can be secured from banks.

Optimised Loan Acquisition Process

Streamlines documentation required for bank financing decisions.

Enhances transparency for both business owners and lenders.

Informed Financial DecisionMaking

Multi-year projections provide a clear financial outlook for lenders.

Enables businesses to assess their creditworthiness before applying for loans.

Scalability & LongTerm Planning

Helps businesses plan future expansions with structured financial projections.

Ensures better financial management and sustainability.

Comprehensive Financial Analysis Tools

Access structured reports like Form II (Profit & Loss Analysis) and Form III (Balance Sheet Review).

Compare current assets vs. liabilities for financial stability insights.

Use Ratio Analysis for deeper financial assessment and loan feasibility.

Your Office

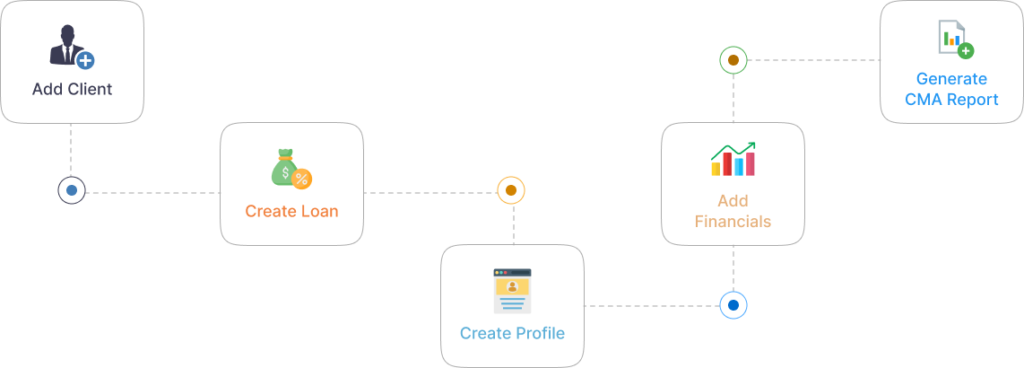

Your Workflow

Frequently Asked Questions

Quick answer to questions you may have.

Plz Call Us at +91 98888 77777

Credit Monitoring Arrangement (CMA) is a structured financial report used by banks to assess business loan eligibility

Businesses input past financials and project future ones to determine loan eligibility.

Forms for profit/loss analysis, balance sheet review, asset-liability comparison, and ratio analysis.

It proves financial stability and helps businesses determine how much they can borrow.

Industries like manufacturing, retail, finance, and professional services seeking working capital financing.

Yes, securely with financial advisors, accountants, and lenders for collaboration.

Yes, WebLedger uses encryption and compliance measures to safeguard sensitive financial information.

It provides financial metrics to assess stability and determine borrowing capacity.

Yes, it helps in financial forecasting, growth strategies, and investment decisions.

It streamlines documentation and ensures accurate financial reporting for better loan approval chances.

Streamline Your Business Today!

Discover the all-in-one solution for Accounting, Office Management, and CRM. Simplify tasks, boost efficiency, and grow smarter.