Best CA Office Management Software for Accounting Firms

In the present scenario of work management, efficiency, and accuracy are the aspects one can’t compromise. In such situations, the role of technology in accounting firms is indispensable. Chartered Accountants (CAs) are no exception; they need outstanding and exceptional office management software to help them streamline their operations and ensure better productivity with compliance. We will discuss the best available CA office management software solutions, what features they possess, their benefits, and how to select the right one for your CA firm.

What Is CA Office Management Software?

CA office management software is a specialized software that has been developed by taking into account all those tasks that chartered accountants and accounting firms indulge-in on a day-to-day basis. It’s developed to bring efficiencies across different fronts.

This software caters to all the multi-faceted needs of accounting professionals as it oversees client relationship and document organization, allows the user to create invoices, time tracking, and more.

Its intuitive design and specialized features help accountants and chartered accountants to optimize their workflows, thus enabling them to deliver superior service and achieve greater success in their practices.

Webledger

Please enter the OTP below to proceed.

Why CA Office Management Software?

Benefits of CA Office Management Software or CA practice management software

are as follows.

Streamlined Automation

Usually when accounting is concerned, it includes tedious and complex tasks, their manual management systems are therefore antiquated and inefficient. The importance at this point comes when a complete solution for streamlining a lot of processes and improving efficiency entirely comes in the form of office management software by CA. The first benefit that can easily be seen in using this software is that it simply automates repetitive tasks.

This automation not only saves time but also minimizes the chances of errors, which are inevitable in manual data entry and processing. CA office management software enables professionals to concentrate their time and expertise on more strategic aspects of their work by automating tasks like data entry, invoicing, and financial reporting, and is the best software for CA office.

Enhanced Collaboration

These software solutions help ensure collaboration among the team members becomes enhanced. Central databases and other means of communication ease their access and sharing this information with colleagues in order to make their working environment coarser and more productive. No matter where people involved might be, updates and notifications keep everyone at one common page.

Treasure trove of Insight

Furthermore, CA office management software offers firm performance insights. Generating customizable reports can help analyze financial data, which allows for the identification of trends, pinpointing areas for improvement, and informing business decisions through a data-driven approach. These not only make the firms more effective in general but also enable them to help their clients more effectively.

CA office management software has significantly increased operational efficiency because when you automate repetitive tasks and workflows, such as data entry, invoicing, and document management. These lengthy processes are streamlined and let professionals focus on high-value tasks, thereby increasing productivity.

Increased Accuracy

This leads to error-prone manual data entry and calculations, which are critical factors in financial accuracy and compliance. It will be significantly enhanced if there are software tools for data management and analysis as it reduces costly mistakes and maintains the integrity of financial information.

Better Collaboration

Any accounting practice requires collaboration of different team members and clients. Central access of CA office management software regarding client information, documents, and channels of communication, helps to smoothen the process of working as a team and hence is sure to keep people together on the same page, creating teamwork and improving the efficiency in terms of communication, which eventually leads to desirable outputs for clients.

Compliance

Regulatory compliance is the most critical concern for accounting firms, as far as strict requirements are concerned, relating to financial reporting, tax filing, and data privacy. CA office management software helps the firm be compliant by having inbuilt features to track deadlines and generate compliant reports while protecting data security. This prevents regulatory penalties and safeguards the reputation of the firm.

In brief, all the benefits of the adoption of office management software by CA assist in improving efficiency and accuracy, thus improving collaboration with clients. By embracing the technological advancements and using various strengths of modern software solutions, accounting firms can reach even higher success and profitability and high client satisfaction in the dynamic business environment of today.

How to Use CA Office Management Software?

The CA office management software has been designed to arrange all the different aspects of a chartered accountant’s practice or use in a structured way:

Set Up:

All the firm’s basic information such as name, address, and contact information should be input first. Fill the system with all client details, names, contact information, and any specific preference or requirement. Customize settings to the firm’s workflow and preference for smooth operation from the start.

Client Management:

Use the software to manage client relationships effectively. This involves adding clients to the system, maintaining detailed records of their information, and managing communication channels to ensure seamless interaction. Tasks can be assigned to specific clients, tracked for completion, and updated as necessary, enhancing organization and client satisfaction.

Document Management:

All significant documents must be kept within the software; this allows for easy uploading, organizing, and retrieval of the most crucial documents. Such documents include financial statements, tax returns, contracts, and more. This ensures that the probability of losing or missing them decreases, not to mention the ease at which access is gained by storing them safely in the system.

Invoicing:

The billing process is streamlined by generating and sending invoices directly from the software. The invoice is customized with information on the services rendered, fees, and terms of payment. Payment status can be followed up on the system to ensure timely receipt of funds and proper financial records that are considered for CA practice management software.

Track the time:

Enhance productivity and accountability through implementation of a software that can track time. Record accurately billable hours, assignments to team members, and monitor real-time progress. Office automation through CA will be optimized to the fullest extent in terms of profitability for firms simply by the efficient allocation of resources.

Reporting:

Use the software’s reporting capabilities to generate detailed financial reports and analytics. Track firm performance, key metrics, and areas for improvement or growth. Firms can make informed decisions with data-driven insights and achieve success in their practice.

Once you walk through these steps and apply every facility offered by CA office management software, you as a chartered accountant will streamline their operations and gain improved client satisfaction besides reaching for more efficiency and profitability in their practice.

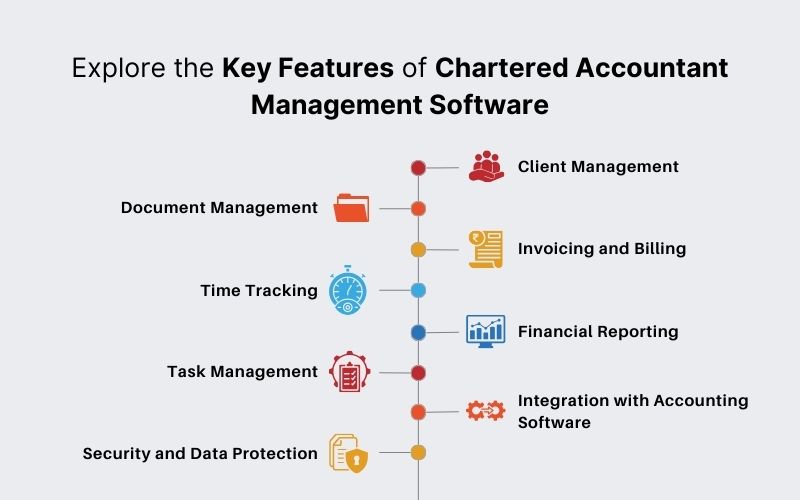

Management Software Features for Chartered Accountants

Management software for chartered accountants typically offers a comprehensive suite of features tailored to meet the unique needs of accounting firms, especially with business accounting software:

Business accounting software offers various features especially within management software that chartered accountants tend to prefer; usually, management software contains most of the features in terms of:

Client Management:

The details about the client, including the contact information, communication history, and specific preferences or requirements, are maintained and organized. This enables the chartered accountant to offer personalized service and maintain good client relationships.

Document Management:

All document storage, retrieval, and organization can be done from a central point. Firms can safely upload, manage, and share documents like financial statements, tax returns, contracts, and correspondence. It also ensures advanced search and version control for easy access of critical documents when needed in account bookkeeping.

Invoicing and Billing:

Invoicing is made easy by sending invoices directly from the software. The invoices can be customized according to services offered, rates, and terms of payment. Invoices can be tracked, payments recorded, and billing reports generated for effective tracking of financial transactions.

Time Tracking:

Accurate tracking of billable hours, activity related to the project, optimizes resource usage, tracks progress of the project. It allows chartered accountants to record and categorize time spent on various activities, thereby ensuring accurate billing to clients and improving productivity by using cloud-based accounting software.

Financial Reporting:

Create complete financial reports and statements to use for the analysis of the firm’s performance, monitoring key metrics, and decision-making with data. Report templates can be tailored according to specific clients or regulatory requirements to ensure that compliance and transparency are maintained by chartered accountants.

Task Management:

Organize and prioritize tasks efficiently to manage workflows and deadlines effectively. Task management features help chartered accountants to assign tasks, set deadlines, and track the status in real-time. Integrating with calendars and using notifications ensures timely completion of tasks and improves team collaboration.

Integration with Accounting Software:

Seamless integration with the top accounting software platforms to facilitate a smooth transfer of data as well as automation of the workflow. The integration facility helps chartered accountants synchronize client information, financial data, and transaction records between management software and accounting systems to avoid duplication and eliminate errors.

Security and Data Protection:

It ensures that sensitive client information is kept confidential and integrity of data. Management software for chartered accountants usually employs encryption, access controls, and audit trails to protect data from unauthorized access, breaches, or incidents of data loss.

With these advanced features, management software help chartered accountants work better, with higher productivity, and also more accurate and high-value servicing of clients; the software is responsive to the regulatory requirements and allows continuous maintenance of the highest possible standards of data security and confidentiality.

What Do Cloud-Based Practice Management Software Offer CA Firms?

Cloud-based practice management software has multiple advantages for CA firms which use online accounting software:

Accessibility:

The cloud-based practice management platform allows the chartered accountant and their teams to access the data, tools, and applications irrespective of location as long as there is internet. A member of staff can access any device that includes a laptop or tablet and a smartphone or any other portable gadget; this provides for improved productivity and responsiveness in team-based collaboration.

Scalability:

Highly scalable, hence easy on CA firms that can increase the usage if a change in requirements so does the change in a business. It can scale out its clientele or increase the services at which extra resources or additional features can be quickly spun up quite smoothly without an investment on infrastructure and involves long set-up processes. At some times when there is decreased demand or season, firms are able to reduce the scaled resources for proper utilization or cost-effectiveness.

Collaboration:

Real-time collaboration is probably one of the main advantages in cloud-based practice management software. All team members can work collaboratively on projects, share documents, and communicate in real time, regardless of their geographical location. Such shared workspaces, commenting on documents, and instant messaging allow for easy collaboration and teamwork, which increases teamwork, enhances communication, and promotes efficiency in the firm.

Security:

Cloud-based practice management software primarily emphasizes data safety and is aligned with leading industry compliance standards. Sensitive encryption protocols, including multi-factor authentication, update security continually to ensure that customer information and sensitive data aren’t used by unauthorized individuals to gain or cause data breach. Proper cloud providers use strict certification of security levels and even comply with those standards by following the finest security.

Cost-Effectiveness:

Cloud-based solutions are cost-effective because they do not require an upfront investment in hardware and ongoing maintenance costs related to traditional on-premises software deployments. CA firms can subscribe to practice management software in the cloud pay-as-you-go, that is, only for the features and resources used. Subscription-based pricing reduces upfront capital expenditures, enhances budget predictability, and allows better resource allocation, thus ultimately improving profitability.

Using accessibility, scalability, collaboration, security, and cost-effectiveness offered by cloud-based practice management software, CA firms can optimize their operations, enhance client service, and maintain a competitive edge in the business environment.

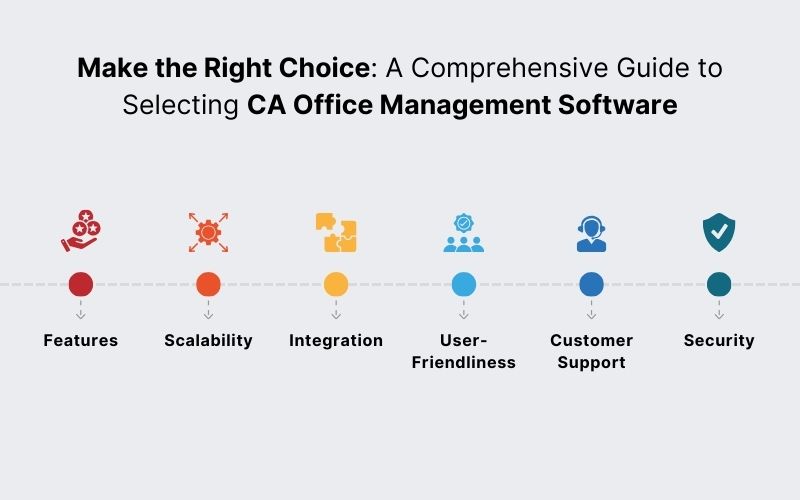

Choosing The Right CA Office Management Software

When selecting CA office management software, consider the following factors:

Features:

Start with the specific needs and workflows of your firm. Evaluate the features and functionalities of the software to check if they meet your needs. Look for essential features such as client management, document management, invoicing, time tracking, and reporting capabilities. Also, see if the software has specific features to cater to the needs of chartered accountants, like compliance tools, tax preparation modules, or integration with regulatory databases.

Scalability:

Select a software solution that can grow with your firm and meet its changing needs. Consider the number of users, client volume, and expansion into new service areas or geographic locations. Look for scalability features such as flexible pricing plans, customizable workflows, and the ability to add or remove users and features as needed without disruption to your operations.

Integration:

The integration with any existing accounting software, other productivity tools, and third-party applications of your firm should be flawless. Compatibility with popular accounting software platforms would ensure smooth data exchange and workflow automation. Moreover, check integration capabilities with industry-specific tools or regulatory databases to further streamline compliance and reporting.

User friendliness:

This means that the software solution selected is intuitive and user-friendly without the need for much training to get started. A well-designed interface will help users become more productive, error-free, and widely accepted in the team. Features that include customizable dashboards, drag-and-drop functionality, and contextual help resources will make it easier to use and will increase user satisfaction.

Customer Support:

Evaluate the quality of customer support and maintenance the software vendor provides. Choose a vendor that has a reputation for good customer support, quick technical support, and continuous updates of the software, including patches. Determine whether the channels of support are available, such as phone, email, live chat, or an online knowledge base, so that issues or concerns are dealt with promptly.

Security:

The protection of data and adherence to industry standards must be a top priority for any software solution. Ensure that the access controls, robust encryption, and audit trails are part of the software so that there is no incidence of unauthorized access, breach, or loss of data regarding sensitive client information. Always verify whether the vendors meet the industry-specific requirements like GDPR, HIPAA, or SOC 2 to reduce the regulatory risk and safeguard your firm’s reputation.

Carefully weighing these factors and conducting adequate research and vendor analysis, you can select the appropriate CA office management software for your firm, enhance productivity, and drive success in your practice.

What To Expect When Implementing a CA Office Management Software?

The following aspects are to be expected while implementing a CA Office Management Software.

Assessment:

Assess all the needs of your firm from workflow processes to client management requirements and team collaboration needs. Identify the key stakeholders involved in the implementation process of the firm and define the clear goals and objectives of the implementation project.

Selection:

Based on the above assessment criteria, evaluate and select the most appropriate software solution that best fits your firm’s needs and objectives. Consider factors such as features, scalability, integration capabilities, user-friendliness, customer support, and security.

Configuration:

Once the software solution has been selected, the options, workflows, and the user permission will be changed according to the firm-specific requirements and processes. So, it configures the software in its branding terms and terminology that supports the work processes preferred and used in the firm along with all the systems.

Training:

Conduct extensive training sessions to make team members aware of the features, functionalities, and best practices of the software. Provide hands-on training sessions, online tutorials, and user guides that will help users become familiar with the software and help them make the most out of it. Tailor training sessions according to different user roles and proficiency levels so that everyone becomes comfortable and confident using the software.

Testing:

Comprehensive testing of the software so that problems or discrepancies related to the software are identified, and such issues are rectified before final launch. Test functionality, workflow and scenarios so that the application functions with satisfactory performance and satisfies the requirements of the firm. Also, seek user’s response from the testing and adopt and refine changes as necessary.

Deployment: Roll it out incrementally to different departments or teams as the firm prefers and can ready up for it, or implement it all at once within the organization. Properly communicate with team members the plan of implementation, timelines, and changes to happen in order not to create significant disruptions and ensure smooth transitions in this new software.

Monitoring and Support:

Monitor the performance of the software, user adoption, and feedback after deployment. Tackle any concerns or issues from users promptly and provide support and maintenance as required. Keep abreast of updates, patches, and new features from the vendor and implement them in your firm’s processes to maximize the benefits of the software over time.

With the time and efforts spent on the implementation process, your firm will be able to integrate CA office management software into its operations and hence increase efficiency, enhance collaboration, and succeed in serving clients and managing workloads.

Streamline Your CA Practice with Webledger

WebLedger is the ultimate answer to revolutionize your CA practice. Here’s how WebLedger can streamline your operations and elevate your practice to new heights of efficiency and productivity:

Cloud-Based Convenience:

Bye, bye desktop software. WebLedger has a cloud-based architecture wherein you and your team will be able to access that important financial data anytime anywhere and this will facilitate teamwork and flexibility.

Complete Compliance:

The headache of compliance-related tasks is all gone. Our software does all the hard work, from GST filing to TDS calculations, so all of these things get completed perfectly and within time with free time for strategic exercises.

Effortless audit procedures:

Simplify and accelerate audit procedures with the help of WebLedger. Our platform automates core audit processes, namely 3CA and 3CB, which in turn streamline the entire audit process and generate reports at breakneck speed and accuracy.

a) Simple filing of income tax return – through the portal of WebLedger- that lets you create numerous forms of ITRs out of your books of account with no need to file and thereby cutting out many mistakes.

b) Efficient Generation of Project Report or even the generation of Credit Monitoring Arrangement (CMA) – the automated accounting work for recognition of desired favorable rate that can ease generation for complete project report by its efficient use of computing abilities in saving man hours and time.

c) Centralized Workboard – Track the tasks of your team members with WebLedger’s centralized Workboard. Monitor work efficiency, track completion of tasks, and ensure smooth functioning of your practice.

Conclusion

Investing in the right CA office management software can significantly enhance the efficiency, accuracy, and competitiveness of accounting firms.

It will allow the chartered accountants to tap the power of technology, improve the working, enhance collaboration, and achieve more success in the dynamic business environment. Be it automation of tedious jobs, improvement in compliance, or valuable insights that the data-driven analytics can generate, WebLedger is a total solution for accounting professionals. Ultimately, it’s an investment in your future success and sustainability of your accounting practice.