Cloud Based accounting software represents a transformative leap in how businesses manage their financial processes. Unlike traditional accounting solutions that require on-premises installation, cloud accounting operates on remote servers, following the Software as a Service (SaaS) model. In this exclusive approach, all application functions occur off-site, eliminating the need for individual desktop installations.

The essence of cloud accounting lies in the accessibility it provides. Users can access accounting applications remotely, facilitated through the Internet or other network connections, thanks to cloud application service providers. This liberates businesses from the hassles of local software installation and maintenance.

Beyond accessibility, cloud accounting fosters enhanced collaboration. With data processed in the cloud, employees across various departments, remote workers, or those in branch offices can access the same data and use identical software versions. This streamlined collaboration ensures consistency and efficiency in financial operations.

Why Do Businesses Need Cloud-Based Accounting?

Accounting and bookkeeping software have become indispensable tools, offering benefits to businesses of all sizes. Even sole proprietors can leverage these tools to streamline tasks and enhance efficiency. Notably, recurring invoices for clients can be effortlessly managed through automation features, which gives sole proprietors liberty to focus on core business activities.

On the other hand, medium-sized and large businesses experience a value in cloud-based accounting solutions. With the use of such platforms, the businesses can have the facilitatate seamless data entry, efficient tracking of accounts payable and receivable, streamlined payroll management, along with real-time updates to journal entries. The versatility of business accounting software is beyond routine tasks, which empowers businesses to generate insightful reports.

At the end such business reports helps in aligning business strategies with short-term and long-term goals.

Benefits of Using Online Accounting Software

Cloud based accounting software is a revolutionized tool for financial management, providing transformative benefits:

- Accessibility: With this, one can have benefits of secure access to financial data from any device, anywhere, coming with flexibility and on-the-go productivity.

- Effortless Collaboration: There is a solid chance of real-time collaboration, which eliminates email exchanges, making way for multiple users to work simultaneously on the latest data, which is able to streamline tasks.

- Time-saving Automation: Automate manual tasks, from creating invoices to payment reminders, enhancing efficiency and reducing errors.

- Enhanced Security: Robust security measures, including encryption and automatic data backup, ensure the safety and integrity of financial data.

- Improved Accuracy: Real-time syncing prevents errors, notifying users of potential issues before committing, maintaining precise accounting records.

- Real-time Tracking and Reporting: Monitor expenses, sales, and inventory in real time, with dedicated dashboards providing comprehensive insights.

- Paperless Operation and Sustainability: Eliminate paperwork, expedite processes like invoicing, and reduce costs associated with printing and posting, contributing to sustainability.

- Improved Invoicing Processes: Generate professional invoices swiftly, create recurring invoices with a click, and manage late payments effortlessly.

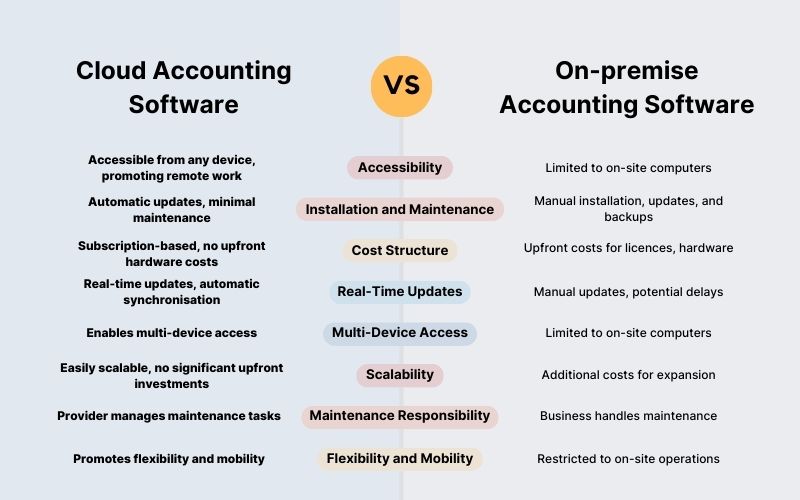

Cloud Accounting Software vs On-premise Accounting Software

The debate between cloud accounting software and on-premise accounting software centers around their hosting and accessibility. On-premise accounting software is localized and hosted on the business’s servers, while cloud accounting software is securely hosted by a third-party provider, accessible through an internet connection. Here are the key differences and benefits:

1. Accessibility:

On-Premise: Limited to on-site computers.

Cloud: Accessible from any device with an internet connection, promoting flexibility and remote work.

2. Installation and Maintenance:

On-Premise: Requires manual installation and maintenance, including updates and backups.

Cloud: Automatic updates, backups, and minimal maintenance, handled by the cloud provider.

3. Cost Structure:

On-Premise: Involves upfront costs for software licenses, hardware, and ongoing maintenance expenses.

Cloud: Subscription-based model with no upfront hardware costs, making it scalable and cost-efficient.

4. Real-Time Updates:

On-Premise: Updates may require manual implementation, leading to potential delays.

Cloud: Real-time updates and automatic synchronization ensure accurate and current financial data.

5. Multi-Device Access:

On-Premise: Limited to designated on-site computers.

Cloud: Enables multi-device access, fostering collaboration and flexibility.

6. Scalability:

On-Premise: Expansion may incur additional costs for licenses, hardware, and maintenance.

Cloud: Easily scalable, accommodating business growth without significant upfront investments.

7. Maintenance Responsibility:

On-Premise: Businesses bear the responsibility for software and hardware maintenance.

Cloud: Maintenance tasks, including backups and updates, are handled by the cloud provider.

8. Flexibility and Mobility:

On-Premise: Restricted to on-site operations, limiting mobility.

Cloud: Promotes flexibility and mobility, allowing access from anywhere with an internet connection.

Top Accounting Software Solutions for Efficient Financial Management

- Webledger

WebLedger transforms financial management through cutting-edge cloud solutions. Tailored for businesses seeking efficiency and compliance, it combines ease of use with powerful features. With a focus on accessibility, GST compliance, and seamless TDS management, WebLedger stands out as a top choice for modern businesses.

- Xero:

Xero’s cloud-based program provides a range of accounting features, including account management, invoicing, billing, and expense reporting. It’s user-friendly, integrates with numerous applications, and offers flexible pricing plans.

- Zoho Books:

Zoho Books, part of the Zoho suite, offers accounting and invoicing solutions. While its integration with external apps may be limited, it excels in invoicing features. It provides tiered pricing plans, including a free option for smaller businesses.

- FreeAgent:

FreeAgent simplifies accounting for small businesses with features like double-entry bookkeeping, expense tracking, and invoicing. It’s designed for easy setup and caters to both UK and US users with a flat monthly fee.

- Wave Accounting:

Wave Accounting, a free cloud-based program, targets small businesses with features like invoicing, expense tracking, and payroll options. Its simplicity and cost-effectiveness make it suitable for businesses with fewer than ten employees.

- Sage Business Cloud Accounting:

Sage Business Cloud Accounting, focusing on simplicity, offers features like automatic invoicing, payment acceptance with Stripe, and one-on-one sessions with Sage accountants. It provides flexible pricing plans for varying business needs.

- QuickBooks Pro:

QuickBooks Pro is the desktop version by Intuit, known for its feature-rich capabilities. While not cloud-based, it offers powerful solutions and is a go-to for businesses requiring advanced features.

- FreshBooks:

FreshBooks, an early player in cloud-based accounting, emphasizes ease of use. Originally an invoicing tool, it now includes expense and time tracking, financial reports, and more. It’s tailored for freelancers and businesses of various sizes.

- Less Accounting:

Less Accounting serves as an alternative for businesses seeking basic accounting features. With a focus on simplicity, it offers income and expense tracking, invoicing, and basic reporting. It’s suitable for businesses with straightforward accounting needs.

- Kashoo:

Kashoo provides a simple accounting solution for small businesses, emphasizing features like bank imports, invoicing, expense reporting, and tax capabilities. It’s designed for businesses not requiring inventory management within the software.

How to select the best Cloud Based Accounting Software Solutions?

- Evaluate the Size of Your Business: Consider the annual revenue of your business. Different accounting solutions may be better suited for small, medium, or large enterprises.

- Assess Your Trade Specifics: Understand the nature of your business. Construction businesses with large projects may have different accounting needs than service-oriented businesses with numerous small contracts.

- Define Your Budget Range: Determine the budget you have in mind for accounting software. While specialized solutions may offer enhanced functionality, they often come with a higher cost.

- Prioritize Security and Reputation: Security is paramount. Research and analyze the security measures of the cloud accounting service provider. Look into their history, client base, and request references to assess their reputation.

- Consider Flexibility for Growth: Anticipate the growth of your business. Choose a service provider that offers flexible plans, providing room for your company’s expansion and evolving accounting needs.

- Evaluate Customer Service: Test the responsiveness and qualifications of the service provider’s customer service. Contact them with your queries and check if they have qualified accountants on their team. A reliable support system is crucial.

How does Business Accounting Work in Small & Medium Enterprises?

In Small and Medium Enterprises (SMEs), business accounting involves systematically recording financial transactions, managing expenses, and ensuring compliance. SMEs typically use small business accounting software to streamline processes like invoicing, payroll, and tax preparation. Accountants or business owners maintain ledgers, track income and expenses, and generate financial reports for informed decision-making. This financial transparency aids in budgeting, identifying growth opportunities, and fulfilling regulatory requirements. The goal is efficient financial management, enabling SMEs to thrive and understand the complexities of business operations.

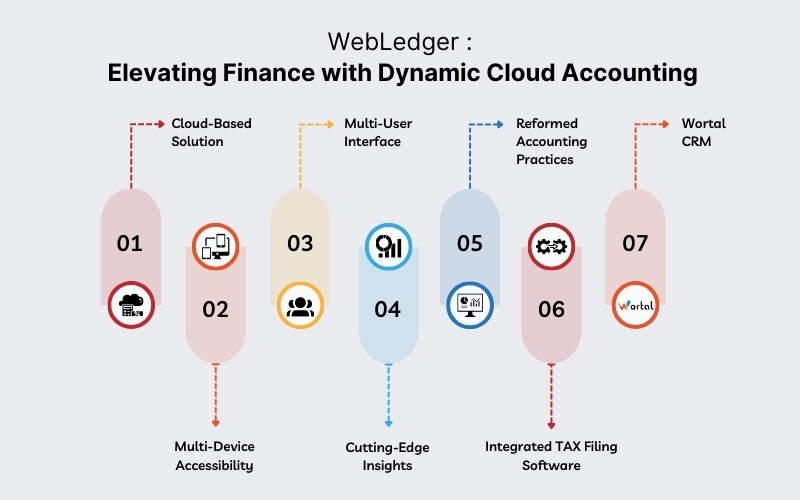

Financial Excellence: WebLedger’s Dynamic Cloud Accounting Features

- Cloud-Based Solution: Elevate financial management with the ease of cloud accessibility. WebLedger’s architecture ensures seamless access to various business needs, including e-commerce, share market operations, and multi-branch functionalities.

- Multi-Device Accessibility: Enjoy the convenience of managing your accounts anytime, anywhere. WebLedger provides CA practice management software with multi-device accessibility, ensuring flexibility and convenience for users on the go.

- Multi-User Interface: Fostering teamwork, WebLedger boasts a multi-user-friendly platform. Collaborate efficiently with team members, streamlining financial processes and enhancing productivity.

- Cutting-Edge Insights: Make informed and prudent choices with modern insights provided by WebLedger. The software goes beyond traditional reporting, offering advanced analytics and insights to guide strategic financial decisions.

- Reformed Accounting Practices: WebLedger Books introduces reformed accounting practices, going beyond mere compliance. From cloud accounting to multi-branch management, striking dashboards, and efficient inventory management, it caters to diverse business needs.

- Integrated TAX Filing Software: WebLedger Office emerges as an integrated TAX filing software, putting compliance on auto-pilot. From client management to income tax filing, auditing, GST filing, workboard, billing, and more, it streamlines the entire compliance process.

- Wortal CRM: Simplify, streamline, and personalize customer experiences with Wortal CRM. From lead management to inventory management, after-sales service management, user access control, interactive dashboards, and in-depth reports and analysis, it’s your ticket to boosting sales effortlessly.

Conclusion

The evolution of accounting practices is evident in the transformative power of cloud-based solutions. The featured online accounting software solutions cater to diverse business needs, offering scalability, efficiency, and real-time financial tracking. As businesses connect with the digital transformation, selecting WebLedger for the right cloud accounting software becomes pivotal for streamlined operations, improved decision-making, and sustained financial excellence. With WebLedger you will get a leader, with accessibility, collaboration, and exceptional insights.