Best Practices for Generating CMA Data Report

Practices for Generating CMA Data Report

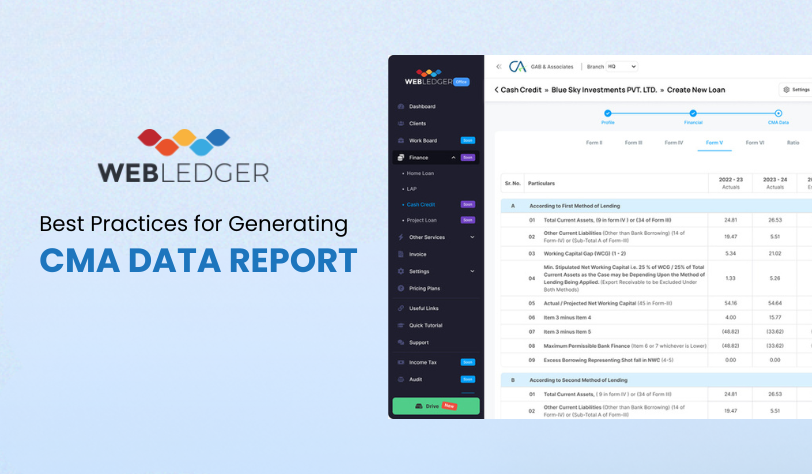

As it is from the accounting, finance, and loan business, we are well aware of the fact that proper and informative financial reporting is a very significant aspect. Among all the reports issued, there is a very significant report that is important in credit analysis and financial decision-making: the CMA (credit monitoring arrangement) data report. It is not just a list of numbers, but it shows the story behind the numbers; this can reveal whether the business is healthy or unhealthy.

The progression of the business could be determined. With enough effort and using the proper tools and approaches, a good CMA data report becomes an asset to any business. This article goes into the best practices for generating CMA data reports, which will be informative and helpful in creating reports that are accurate and insightful.

What Is a CMA Data Report, and Why Is it Important?

Before going in-depth in best practices, let’s briefly define what a CMA data report is as well as why it’s so very important. In summary, a CMA report presents a detailed review of a borrower’s financial performance over a specified period. Such reports contain historical financial data, projected financials, key ratios, and any other relevant data. To determine the creditworthiness of the borrowers, lenders use these reports and evaluate their ability to repay funds.

Businesses apply CMA reports for internal analysis of performance and strategic planning. They also make use of them to secure investments. A well-prepared CMA report may mean the difference between loan approval and rejection or between attracting investors and missing opportunities.

Challenges in Generating CMA (Credit Monitoring Arrangement) Reports:

The preparation of accurate and timely CMA reports involves several challenges. The major challenges are listed below:

Webledger

Please enter the OTP below to proceed.

- Data Collection: There may be times when obtaining necessary financial data is challenging because these details would have to be gathered from many sources. It’s very tiring and time-consuming work because it would entail opening many databases and spreadsheets. At times, discrepancies due to old information or different formats could make the compilation process troublesome.

- Data Consistency: The various financial statements must be accurate and consistent and this is required in the reporting periods with several reporting standards. This may be quite hard to obtain. Since differences in reporting practices vary, accounting standards change by variations in the differences that get distorted and the reporting becomes a little complex when to compare or even analyse.

- Forecasting: For the CMA reporting, forecasting future financial performance is necessary. It requires a careful analysis of past data, current market conditions, and realistic assumptions. Accurate forecasting requires a good understanding of both internal financial factors and external economic influences. Dealing with uncertainty adds to the complexity since overly optimistic or pessimistic predictions can result in poor strategies.

- Interpretation: This involves understanding and interpreting large volumes of financial data in order to spot key trends and insights. However, this can be overwhelming, especially for individuals who possess no experience in financial analysis. Misinterpretations might lead to the wrong conclusions, which can then be used to create more damaging decisions made over planning.

- Time Constraints: The constraint on dates of submitting the finance reports exerts huge pressure on the financial teams, under which conditions it might make one impatient and hence compromise proper diligence. Rushing is always risky of error, thereby making analyses partially superficial or very low-quality submissions with inaccuracies at the tail end of the report.

Generating CMA reports involves several challenges that can affect their accuracy and usefulness. To overcome these issues, teams need to improve data collection, standardise reporting, enhance forecasting techniques, develop interpretation skills, and effectively manage time pressures.

CMA Reporting Best Practices: A Step-by-Step Guide

To overcome these challenges and create high-quality CMA reports, consider the following best practices:

-

Establish a Clear Framework

- Define Objectives: Before you start writing, define the report’s purpose. Is this for a loan application, internal analysis, or something else? Know what you are trying to find out, and that will help define what data you collect and what kind of analysis you are going to do.

- Identify Key Stakeholders: Who is going to be using this report? What information do they need? This will enable the creation of reports that better meet their needs.

- Plan Timelines: Provide reasonable timelines for collecting the data and its analysis and then generating the report. You will be guided to avoid having everything at your fingertips on a last-minute basis.

-

Data Collection and Organisation

- Finding Sources of Data: Seek out all probable sources of financial data, accounting software, bank statements, tax returns, etc., or any other relevant documents.

- Collect Historical Data: Collect historical financial data for a period of at least 3-5 years. This will serve as a foundation for trend analysis and projections.

- Ensure Data Accuracy: Check all data for accuracy and consistency. Errors in the data can result in misleading conclusions and incorrect decisions.

- Systematize Data: Use spreadsheets or specialised CMA data tools to organise the data in a clear and consistent format. This will make it easier to analyse and interpret the information.

-

Financial Analysis and Projections

- Key Ratios: Calculate key financial ratios, such as profitability ratios, liquidity ratios, and solvency ratios. Valuable insights are being provided by these reports to determine the financial health of the business.

- Analysis of Trends: Determine the trend of the financial data and the key ratios. This will indicate how the performance of the company is changing with time and points to potential causes for concern.

- Projection of Realistic Expectations: Project future performance of the firm based on past performance and given industry trends. Do not forget to state any assumptions made;

- Stress Testing: Develop a stress testing scenario to determine adverse events’ effects on the firm’s financial performance. It will help you come up with strategies on how to mitigate this risk.

-

Report Creation Tips and Structure

- Clear and Concise Formatting: Use clear and concise language, avoid jargon, and present the information in a logical and easy-to-understand format.

- Graphical representation: Graphs and charts can be used to present the data in an understandable way. Data visualisations enable the trends and findings to be represented clearly.

- Executive Summary: The summary of the main findings and the report conclusions is always necessary as an executive summary. This section is helpful for a busy stakeholder who will not have enough time to read the full report.

- Analysis of Financial Data: Deep analysis of financial data. In the final presentation, detailed analyses and explanations for the most relevant key ratios, trends, and projections.

- Appendix supporting documents: These will include appendices for all financial statements, reports, and other related documentation.

-

Make full use of appropriate CMA software and data tools:

- Streamlined Data Entry: Streamline CMA data tools that automate entry and import from other sources, saving time and effort and reducing errors.

- Automated Computations: Automatically Compute Key Ratios, Financial Analysis: One of the components of good and effective CMA software gives the ability to automatically compute key ratios and perform financial analysis, saving much time and ensuring accuracy.

- Projections: You should be able to choose software, which may well possess strong projection capabilities so you could prepare quite dependable financial projections.

- Tailored Reports: The software needs to enable a user to offer customised style as well as report content for satisfying the varied reporting requirements of stakeholders.

- Data Security: The software shall be capable of ensuring proper security of data that would prevent disclosing sensitive financial data.

-

Improving Over Time:

- Regular Review: Regularly review the CMA reporting process to identify areas for improvement.

- Feedback: Seek feedback from stakeholders on the clarity and usefulness of the reports.

- Ever Current: Keep abreast with the latest accounting standards and best practices for CMA reporting.

The Human Touch: Let the Numbers Be Your Witness

Numbers can indeed tell a story. However, it is the human touch that brings that story to life. As finance professionals, we need to get beyond presenting data. We need to interpret it, understand the context, and then let the viewer know the story behind the numbers. What are the key drivers of the business’s performance? What are the challenges and opportunities? By adding this human touch, we can create CMA reports that are not only accurate but also insightful and valuable.

Read More: Cloud Accounting: The Next Big Thing for CA and CS

Conclusion

Creating high-quality CMA data reports is important for making good financial decisions. To prepare your CMA report, follow the above best practices. Use reliable CMA software and data tools; combine them with your own insights. A good CMA report is not merely a collection of numbers; instead, it shows information in the most effective communication, supports an analysis, and aids in strategic planning. In this way, the report portrays your knowledge and adds value to the financial world. Implementing these best practices can improve your process of preparing CMA reports and make you a trusted finance advisor.