In business operations, automation is a tool of transformation, which has given a new way of working to various sectors. While several sectors are making these enhanced automation changes, one critical area where automation has made significant inroads is bookkeeping. In this blog, we will get a brief idea of Bookkeeping and how it is going to be impacted by automation. We will get to know more about the ledger’s accounting software.

In this article, we will discuss various factors of manual bookkeeping, including limitations, and how the tasks can be automated. There will be details and a step-by-step guide on how to automate bookkeeping processes, along with the role of a professional accountant.

What is Bookkeeping?

Bookkeeping is termed as a systematic process of recording, organizing, and managing a company’s financial transactions. In this task, there is a need to maintain accurate and detailed records of all financial activities, including income, expenses, assets, liabilities, and equity. The primary goal of bookkeeping software is to provide a clear and organized overview of a business’s financial health, enabling informed decision-making, financial analysis, and compliance with regulatory requirements.

Key components of bookkeeping include

Recording Transactions: Documenting financial transactions in journals or ledgers, including sales, purchases, receipts, and payments.

Categorizing Transactions: Classifying transactions into specific accounts, such as revenue, expenses, assets, liabilities, and equity.

Balancing Accounts: Ensuring that debits and credits match to maintain the accuracy of financial records.

Bank Reconciliation: Comparing recorded transactions with bank statements to identify and rectify discrepancies.

Generating Financial Statements: Preparing financial statements, including the income statement, balance sheet, and cash flow statement, to assess the business’s performance.

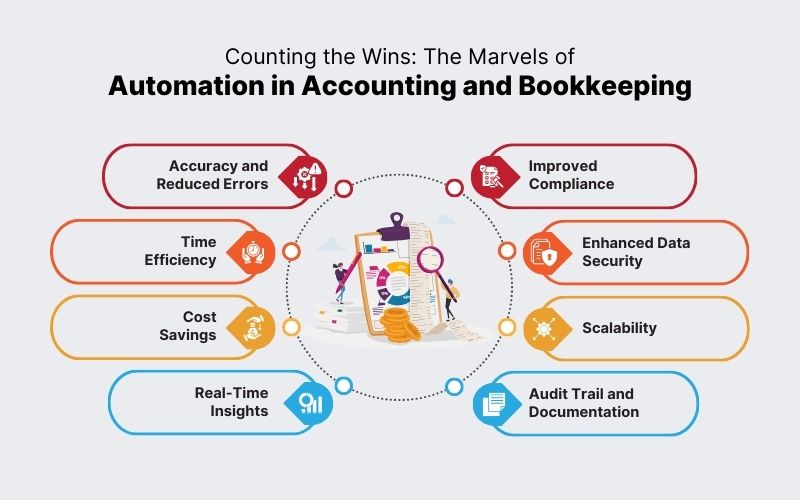

Benefits of Using Automation for Accounting and Bookkeeping

Accuracy and Reduced Errors:

- Automation reduces the likelihood of human errors associated with manual data entry, calculations, and reconciliation.

- Automated systems perform calculations consistently, minimizing the risk of miscalculations or transposition errors.

Time Efficiency:

- Automation streamlines repetitive tasks, allowing for faster processing of financial transactions and reports.

- Time-consuming manual processes, such as data entry and reconciliation, are automated, freeing up time for more strategic financial activities.

Cost Savings:

- Automation reduces the need for extensive manual labor, leading to lower labor costs.

- The efficiency gained through automation can result in cost savings related to both time and resources.

Real-Time Insights:

- Automated systems provide real-time updates on financial transactions and account bookkeeping balances, enabling businesses to make informed decisions promptly.

- Access to up-to-date financial data facilitates proactive financial management.

Improved Compliance:

- Automation helps ensure compliance with tax regulations, financial reporting standards, and other legal requirements.

- Automated systems can generate accurate and timely reports, aiding in regulatory compliance.

Enhanced Data Security:

- Automated accounting systems often come with robust security features to protect sensitive financial information.

- Access controls, encryption, and secure data storage contribute to improved data security.

Scalability:

- Automated systems are scalable and can adapt to the growing needs of a business.

- As the business expands, automated accounting processes can handle increased transaction volumes efficiently.

Audit Trail and Documentation:

- Automated systems maintain a comprehensive audit trail, documenting all financial transactions and changes.

- This feature enhances transparency and provides a clear record of financial activities for auditing purposes.

Integration with Other Systems:

Automated accounting systems can often integrate seamlessly with other business software, such as ERP (Enterprise Resource Planning) systems, providing a holistic view of business operations.

Focus on Strategic Activities:

By automating routine tasks, accounting professionals can redirect their efforts toward strategic financial planning, analysis, and decision-making.

The Limitations of Manual Bookkeeping

- Susceptibility to Human Error

Manual bookkeeping, despite its historical significance, faces a notable limitation in its susceptibility to human error. The process of manually entering data opens the door to mistakes such as miscalculations, transposition errors, and oversights. These inadvertent errors can have profound implications on the accuracy of financial statements and the reliability of business data.

- Time-Consuming and Labor-Intensive Processes

Another significant drawback of manual bookkeeping is the time-consuming and labor-intensive nature of its processes. The manual recording, organizing, and updating of financial transactions demand substantial human effort, leading to prolonged turnaround times. This not only affects overall productivity but also diverts valuable human resources away from strategic and analytical financial management tasks.

- Lack of Real-Time Data Access

Manual bookkeeping falls short in providing real-time data access, a crucial aspect in today’s dynamic business environment. The delay in obtaining up-to-date financial information hampers timely decision-making for businesses. In a fast-paced setting, having access to real-time data is paramount for making informed choices and adapting to rapidly changing circumstances.

- Advocating for Automation

Recognizing these inherent challenges, WebLedger advocates for a shift towards automated bookkeeping. Automated systems harness technology to minimize human error, streamline processes, and offer instantaneous access to real-time financial data.

Tasks that Can be Automated

WebLedger Books utilizes a combination of Robotic Process Automation (RPA), Artificial Intelligence (AI), and Machine Learning (ML) to streamline various bookkeeping tasks. Some of the tasks that can be efficiently automated include the categorization of transactions, investigation of transactions, enrichment of transactions, receipt filing, managing payroll, managing invoices, and expense management. Automation ensures speed, accuracy, and real-time data availability, addressing the shortcomings of manual processes.

Man-Machine Collaboration in Bookkeeping

While automation plays a pivotal role in simplifying bookkeeping processes, WebLedger emphasizes the importance of man-machine collaboration. Automation bots excel at handling repetitive tasks, but human intervention remains crucial for managing ambiguous tasks, determining the level of detail in account charting, and reviewing records to identify and fix errors. Successful bookkeeping accounting software requires a strategic approach that combines the strengths of both automation and human expertise.

How to Automate Bookkeeping with WebLedger Books

WebLedger Books offers a comprehensive solution to automate your bookkeeping tasks, allowing you to focus on growing your business. Here’s a guide on how to automate bookkeeping with WebLedger Books:

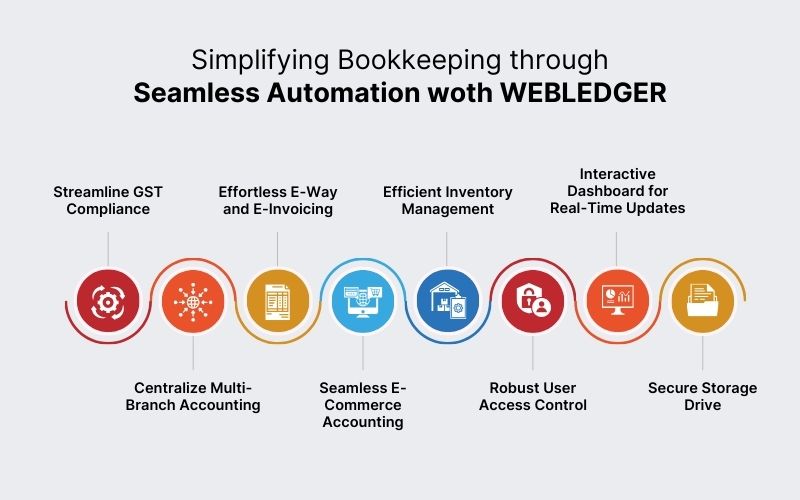

- Streamline GST Compliance: WebLedger simplified GST compliance with its WebLedger chartered accountant software. Seamlessly manage GST filing by producing GSTR 3B and GST-1 directly from the GST portal. Reconcile Input Tax Credit (ITC) with 2A and 2B effortlessly, ensuring full compliance while saving time.

- Centralize Multi-Branch Accounting: Utilize the power of central control with WebLedger’s multi-branch accounting dashboard. Aggregate reports and data from multiple branches in one location, facilitating informed decision-making. Generate standalone and consolidated reports with a single click for accelerated business operations.

- Effortless E-Way and E-Invoicing: Generate e-way bills and e-invoices with just a click, eliminating the hassle of data re-typing. WebLedger reduces the possibility of errors and saves time by automatically fetching invoice data for efficient billing processes.

- Seamless E-Commerce Accounting: Experience uninterrupted e-commerce accounting with automation designed for top platforms like Amazon, Flipkart, Meesh, and Myntra. WebLedger ensures precise and organized entries for seamless transaction management across multiple channels.

- Efficient Inventory Management: Manage your supply chain and inventory efficiently with WebLedger. The tool supports various valuation methods like Weighted Average Method (WAM), First-In-First-Out (FIFO), and Last-In-First-Out (LIFO). Generate analytical reports to identify trends and optimize stock levels.

- Robust User Access Control:Take charge of data privacy with WebLedger’s access control feature. Modify access to information based on roles, ensuring confidentiality and preventing unauthorized data access or tampering.

- Interactive Dashboard for Real-Time Updates: Get real-time updates on your business’s performance with WebLedger’s interactive dashboard. Make informed decisions by accessing dynamic interfaces and controlling your data effectively.

- Secure Storage Drive: Store your files safely in WebLedger’s cloud-based accounting software. Enjoy unlimited storage space, providing access to your data anytime, anywhere, and ensuring you never lose important documents.

Benefits of Choosing WebLedger For Automated Bookkeeping

WebLedger stands out as a reliable and user-friendly platform designed to streamline and automate the bookkeeping process. Let’s explore the key reasons why businesses should consider choosing WebLedger for their automated bookkeeping needs.

- Time Efficiency

WebLedger’s automated bookkeeping feature significantly reduces the time spent on manual data entry. With easy integration and real-time data syncing capabilities, transactions are recorded automatically, freeing up valuable time for business owners and finance professionals.

- Accuracy and Error Reduction

Manual bookkeeping is prone to errors that can have far-reaching consequences. WebLedger employs advanced algorithms and machine learning to ensure accurate data entry and calculation. This minimizes the risk of errors, providing businesses with reliable financial records.

- Real-Time Financial Insights

Businesses need up-to-date financial information for informed decision-making. WebLedger provides real-time insights into the financial health of the business, allowing stakeholders to make strategic decisions promptly. Automated updates ensure that financial reports reflect the most current data.

- User-Friendly Interface

WebLedger boasts an intuitive and user-friendly interface, making it accessible even for those without extensive accounting expertise. The platform is designed with simplicity in mind, allowing users to navigate effortlessly through various features, from transaction recording to generating financial reports.

- Security and Compliance

Security is a top priority for any bookkeeping platform, and WebLedger is no exception. The platform employs robust encryption protocols and follows industry-standard security practices to safeguard sensitive financial data. Additionally, WebLedger helps businesses stay compliant with relevant financial regulations and standards.

- Customization and Scalability:

Every business has unique accounting needs. WebLedger offers customization options to tailor the platform according to the specific requirements of each business. Moreover, the platform is scalable, accommodating the growth of businesses without compromising performance.

- Cost-Effective Solution

Adopting WebLedger for automated bookkeeping eliminates the need for extensive manual labor and reduces the likelihood of costly errors. This cost-effective solution allows businesses to allocate resources more efficiently and invest in areas that contribute to overall growth.

- Integration Capabilities

WebLedger seamlessly integrates with various financial tools and software, providing a comprehensive ecosystem for businesses. Whether it’s syncing with banking platforms, payment processors, or other business applications, the integration capabilities of WebLedger enhance overall workflow efficiency.

- Automated Reporting

Generating financial reports is quite easy with WebLedger. The platform automates the report generation process, offering a variety of customizable templates. Businesses can quickly access income statements, balance sheets, and other essential reports without the hassle of manual compilation.

Wrapping Up

The integration of automation technologies, as exemplified by WebLedger Books, has revolutionized bookkeeping processes. By addressing the limitations of manual bookkeeping, automating repetitive tasks, and emphasizing man-machine collaboration, businesses can significantly enhance the speed, accuracy, and efficiency of their bookkeeping functions. WebLedger Books’ expertise in developing customized automation solutions makes them a valuable partner for organizations seeking to boost productivity and gain a competitive edge in the dynamic marketplace.